Investment partners at VC companies, them selves a little and outstanding coterie, startup investors usually get in touch with an just as limited-knit band of universities their alma mater. In the discovering that will surprise pretty much no-one, Ivy League and Ivy-Plus educational facilities are very much desired from the very best ranks.

Investment partners at VC companies, them selves a little and outstanding coterie, startup investors usually get in touch with an just as limited-knit band of universities their alma mater. In the discovering that will surprise pretty much no-one, Ivy League and Ivy-Plus educational facilities are very much desired from the very best ranks.

– 73 percent from the financial investment lovers had some form of graduate learning. An outstanding 16 percentage of your inhabitants we analyzed retained anMD and PhD, or equal doctoral amount.

– By simply the barest border, a the greater part (51 %) in the financial investment partners in our dataset organised an MBA.

It was this second option figure relating to MBAs that encouraged a pair of abide by-up questions we mean to handle listed here right now. Which online business institutions created one of the most Startup Investors shareholders in current heritage when we increase the pie a lttle bit to add in angel investors as well? Are unique variations of start-up shareholders-in such cases, unique/angel buyers opposed to skilled investment decision lovers-essentially almost certainly going to have gone to enterprise college? And, inside of each individual buyer variety, are there disparities in between males and women’s educational styles?

One Rank Of MBA Programs

Let’s begin with a variation of the items we have in the preceding review of start-up investors’ academic backdrops. Coming up with a conclusive search engine ranking of business institutions-as driven by the number of graduated pupils who key in the concept of start-up shelling out-is easier in theory for motives we’ll enter in a tiny bit.

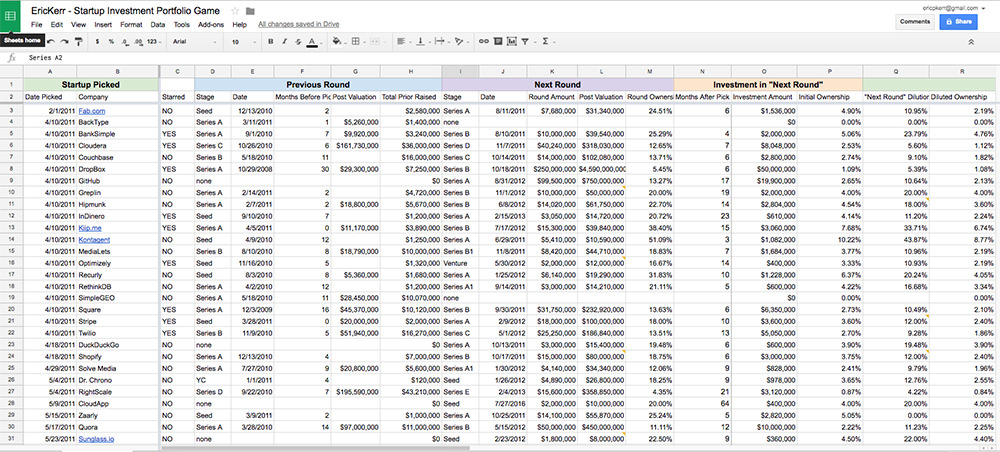

So let us start with the numbers. On the graph beneath, you can find a directory of the very best twenty company colleges for American and Canadian purchasers, startup investors positioned by the quantity of shareholders each one ended up because the year or so 2000.

To produce the graph or chart earlier mentioned, we started out using a substantial dataset of angels and expenditure companions coming from the U.S. and Canada. Using the instructive facts bound to these investors’ information we could focus the place these men and women visited company university.

Everything you observed here is generally associated with an identical trend we diagnosed when looking at just where investment collaborators gone for undergrad. To wit, a somewhat tiny range of enterprise educational facilities can make up a somewhat sizeable portion on the shareholders within our info. And simply like with undergrad investigations, there exists a for an extended time tail with this dispersal, which the surpassing most of MBA holders who didn’tgo to one of these educational facilities should find heartening. Having said that, the odds are very much piled to opt for enterprise classes grads who maintained to get into the top level colleges at the very top.

Are Angels Or Professional VCs Prone To Hold MBAs?

Individual angel traders tend to be productive founders or higher-web-worthy of folks who accumulated their startup committing bankroll by other suggests. So one particular could suppose that they’re more unlikely that to maintain MBAs when compared to the somewhat additional buttoned-up type of institutional VC financial investment lovers. Let’s check if that theory has up.

From the graph or chart listed below, you will observe a area-by-section comparing of those two individual styles.

As details originating from a pretty substantial pair of traders implies, our hypothesis has a tendency to last, at least with that cursory research. Exactly like we seen in our previous examination, we acknowledged that a trim many specialized business cash shareholders carry MBAs. Remember, that is precisely the percentage of folks who visited organization institution most of these MBA-holding investment partners have several other scholar degrees with their title.

Individual angel purchasers, on the other hand, are probably much more associated with the population of so-known as “accredited investors,” which is just the SEC’s way of praoclaiming that somebody is loaded sufficient to bet their very own cash on what ever unsafe proposition they wish to, between new venture collateral to exotic hedge fund practices. Sure, a lot of go to enterprise education – absolutely in bigger phone numbers in comparison to the standard inhabitants – but an enterprise institution degree or diploma appears to be a smaller necessity for this type of entrepreneur.

And this really is a hassle-free segue for our ultimate question: has an MBA basically of the prerequisite for every single individual variety with respect to the gender of the investor included?

Is Gender A Factor In Valuing An MBA Degree?

Let’s start off this part out by acknowledging an regrettable truth: ladies are enormously underrepresented in a great many areas, potentially acutely so in project cash and start-up investment. Although growth is now being designed to parity, the planning is painfully poor.

And what’s correct in their life is true in info. And also initially blush, our discoveries are somewhat bleak. Out from more than 5,500 purchasers-including angels and institutional purchase partners‚just 8.3 percentage are females. (Crunchbase records sexes past just men and women. However, all but a number of purchasers during this dataset had been detailed as male or female. The other several had been not furnished.)

But can do this sex disparity have knock-on results linked to prices of business education attendance? Let’s see.

The graph or chart below illustrates the percentage of male and female MBA-owners between angel buyers.

A little more girl angel purchasers have MBAs than their male alternatives. It’s nonetheless in the world of statistical noises, but only just. This chart could possibly be read as displaying that there is a higher club for women who wants to make angel ventures.

And have you thought about VC investment collaborators? The chart under shows the dysfunction.

Here as well, on this segment on the entrepreneur human population there are many females with MBA diplomas than without having, startup investors although not by considerably. With your a compact small sample sizing, we’re talking about a margin of seven folks. But rounding problems apart, the uniformity among feminine and men expert traders is fairly amazing. The better club case one could make about angel purchase is far less influential below. Put simply, there is a thing that is driving sex inequality between specialist VC buyers, but it is not no matter if one sex is approximately going to receive an MBA.

For Startup Investors, When Does Using An MBA Matter Most?

Within the informal whole world of angel making an investment, the validity of buyers is actually completely bound to their networking systems, the perfectly-getting of current and past portfolio companies, as well as their professional achievements, that features scholastic achievements. Bias-no matter whether it’s implicit or explicit-definitely makes the underrepresented class ought to accomplish with a higher-level just to be noticed as equal to “the business.”

However, when it comes to the professional expenditure collaborators, we have seen an occasion of companies applying a collection of specifications and norms fairly every bit as, no less than where by educative track record is concerned. Simply because the collaboration connection to an institutional investment crew communicates the influence in this instance, there’s less competitiveness on the margins just where differences in instructional background and expert achievements provide a severe competitive edge.

However, in either cases, we also see the power of popularity and alumni networking systems of alma maters. So, the selection of educational facilities is drastically limited to the best reasonably competitive solutions.