You now have at last got funds, it appears you might have gotten to the finish range, but finding funding is simply not the conclusion of your respective new venture journey. It’s time to visit the pulling table yet again. At the very least, you have some anxiously essential tools.

When you are raising cash for the startup investors (markets.financialcontent.com), it helps to also appreciate how the investors you will be pitching could make money for their own use. The solution for forking over buyers is normally not as simple as getting their return on investment and allocating it every bit as one of the essential participants.

For angel capital, endeavor funds money and also other expenditure relationships, there are generally intricate formulas for how the individuals involved in dealing with ventures generate income. Ultimately, you should keep in mind that each of the purchasers want in turn because of their financial resources are pretty simple: more income.

[READ MORE: To become millionaire, fixed these benchmarks]

Exactly what is the effects of bringing up funds?

By searching for money as opposed to getting financing, startups can elevate cash they are underneath no obligation to pay back. However, the opportunity cost of accepting those funds is better – while standard lending options have preset interest rates, new venture equity investors are purchasing a percentage from the firm from your founders.

Which means that the founders are offering investors rights to the number of the corporation income in perpetuity, which may volume to numerous cash. Big-label companies like Amazon, Facebook, and Google were definitely as soon as project-guaranteed startups.

4 approaches new venture buyers can make money from their investment

The new venture is procured by one other firm: To have an individual in the start up, this is certainly usually the quickest way to generate money in your initial financial investment. Every time a startup is received, a venture capitalist could collect cash or new supply (or a blend of the 2 main) out of the attaining company. So, the amount an investor would see lower back on the merger or investment with this kind is determined by his talk about from the start-up plus the valuation the business was remaining procured at (Instance here is Instagram).

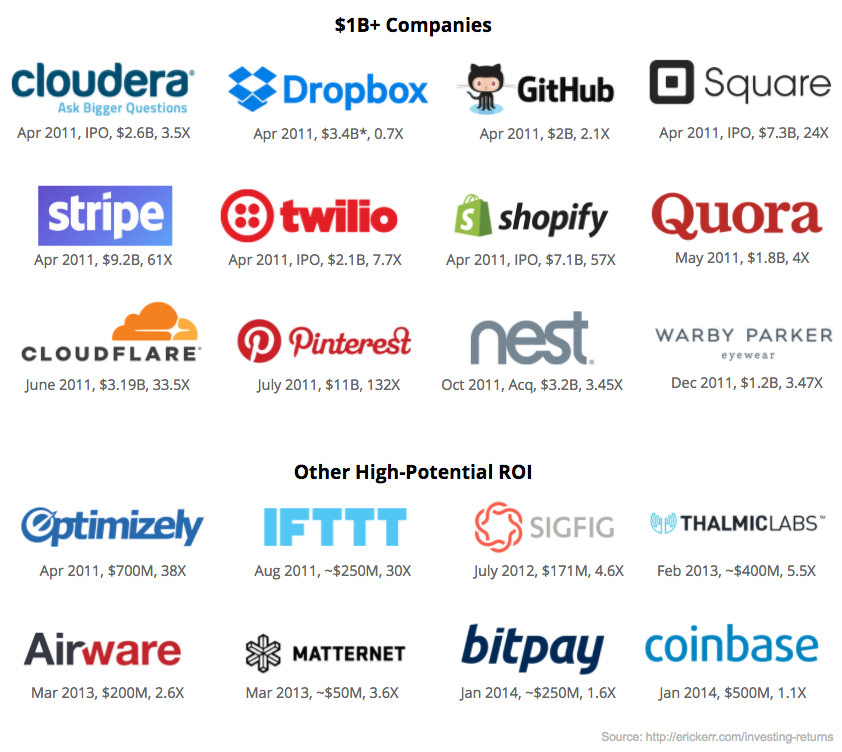

The start up goes general public (IPO): Based on the IPO Playbook, should you have had spent just $ten thousand in Amazon online,Apple inc and Dell, or Microsoft, every time they proceeded to go IPO, you would be a mil us dollars richer just from that financial investment. Apple kicked that 100x ‘Franklin Multiple’ towards the curb that has a 4,581.7Per cent boost in stock importance involving 2002 and 2012 by itself.

The firm will begin shelling out dividends: Some corporations determine to not get bought or IPO. Their creators use a sight of operating huge, stand-alone companies. To pay back buyers, they will shell out section of their cash flow in the form of on-going dividends or maybe the funds buildup in their harmony sheet is big adequate, they will often elect to dividend out a chunk of that money in a 1-time, exclusive dividend.

Investors sell their conveys to additional investors: Investors in startups commonly have the ability to sell their conveys to the other shopper to get a income when they can choose one.

[READ ALSO: MONEY TIPS: Choosing Between Buying Land or Making an investment in Stocks]

Equity essentially suggests possession. Equity represents one’s number of acquisition fascination with a particular corporation. For start up shareholders, therefore the amount of the company’s gives you that any new venture is pleased to target purchasers for the certain cost.

Like a corporation tends to make enterprise advance, new buyers are generally happy to spend a more substantial selling price per be part of up coming rounds of funds, since the start-up has now revealed its possibility of success. Investors make profits proportionate with their quantity of collateral in the start-up should the company changes a profit. The shareholders lose the amount of money they offer sunk.

Returning Money to Investors: How to determine their genuine profit

Often you probably know how much you need brokers to invest, and they are generally requiring a specific fee of return. What dollars runs are you looking to give to offer them that level of return?

If they offer $100,000 and call for a 40Percent level of go back annually, meaning you will should pay them $40,000 every year. In case you agree that they obtain funds in a lump sum in the event the provider runs community, next the 40% substances.

The computation is easy – the whole thanks each and every year could be the past year’s total in addition to the curiosity (40%). In case you calculate the company will likely be really worth $5,000,000 following the 5th year, then this traders will likely need to own 10.8Percent of the business ($537,824 / $5,000,000) to ensure them to obtain their 40% returning.

[READ FURTHER: Exactly What Is A Share Reconstruction and ways in which It Affects You]

The standard idea regarding home equity could be the splitting of the pie. When you start anything, your pie is actually tiny. One has completely of the definitely little cake. Once you have exterior investment decision plus your business expands, your cake will become bigger. Your portion from the bigger cake will probably be bigger than your primary chew-dimension cake. When Google proceeded to go Sergey, public and Larry had about 15% from the cake, each individual. That 15Percent was, on the other hand, a smaller piece associated with a really massive pie.

Let’s look at how the hypothetical start up splits its value from idea step until it will get outer investment:

Idea point: At first, it is merely you. You own 100% of this now and you happen to be only particular person with your organization, you happen to be not really contemplating home equity but.

Co-Founder Stage: As you may start to transform your idea in to a actual physical prototype, you realize that one could genuinely use one other person’s techniques. So, you locate a co-founder. You also realise that considering the fact that she will do 50 % of the work, to ensure you give your co-founder 50Percent.

Soon you realise that you require financing. Until now you do not think you have an ample amount of a doing the job solution to exhibit, therefore you start to look at other options, although you would prefer to go directly to a VC. The Best freinds and family Round, then a Angel Round. And next much more choices:

Incubators and accelerators: These sites typically provide cash, doing the job area, and consultants. Your money is tight – about $25,000 (for 5 to 10% in the provider.)

Angels: Let’s say it is actually even now early days for you, plus your operating prototype is simply not that substantially alongside. You locate an angel who looks at whatever you thinks and also have that it must be value $1 million. He agrees to spend $200,000.

Now let’s assess what number of the company you may get for the angel. We need to create the ‘pre-money valuation’ (exactly how much the company is definitely worth just before new funds enters in) plus the purchase:

Now split an investment from the post-income valuation $200,000/$1,200,000 = 1/6 = 16.7%

[Find Out More: How to compute deduction for staff member compensation plan]

Dilution

How about you, your co-founder plus the relative that sunk? Exactly how much do you have still left? Your stakes will probably be watered down by 1/6. Is dilution bad? No, because your pie is getting greater with each investment decision. Certainly, dilution is poor, since you also are burning off power over your enterprise but. So, what in the event you do? Take financial investment only after it is important.

Finally, you will have constructed the first model and you have grip with individuals. You solution VCs. Simply how much can VCs supply you with? Let’s say the VC values whatever you have right now at $4 million. Again, that may be your pre-funds valuation. He states that he really wants to invest $2 Million. The mathematics is equivalent to within the angel rounded. The VC receives 33.3Per cent of your own business. Now it is his company, too, even though.

Your first VC rounded is the line A. You can now continue on to possess range B, C – at some things possibly in the about three stuff could happen to you. Either you can exhaust funds and no a single may wish to invest, which means you expire. Or, you will get sufficient backing to construct a thing a greater firm hopes to acquire, plus they get you. Or, one does so well that, following quite a few rounds of funding, you want to go open public.

The two main standard motives. Technically an IPO is merely an alternate way to raise hard earned cash, but this point from an incredible number of ordinary people. Through an IPO, a corporation can sell off stocks on stocks and shares and anybody can find them. Since you can now get, you can actually probable sell off a great deal of store at once as an alternative to go to specific investors and ask them to commit. So that it seems like a lot easier method to get money.

You will find another reason to IPO. All of those individuals who have invested in your small business at this point, which include you, are retaining the so-named ‘restricted stock’. Those who have put in to date would like to ultimately translate or offer their confined supply and get cash or unhindered carry, which is certainly almost as nice as funds. This really is a liquidity occasion – when what you have ends up being easily convertible into dollars.

A leading illustration is Google, which started like a startup in 1997 with $1 zillion in seed hard earned cash. In 1999, the firm was increasing swiftly and fascinated $25 million in project budget money, with two VC businesses purchasing approximately ten percent all the organization. In August 2004, Google journeyed consumer, rearing above $1.2 billion for any provider and nearly half a billion dollars money for all those initial investors, a go back of virtually 1,700%.

[READ ALSO: Determining the top Savings Account for yourself]

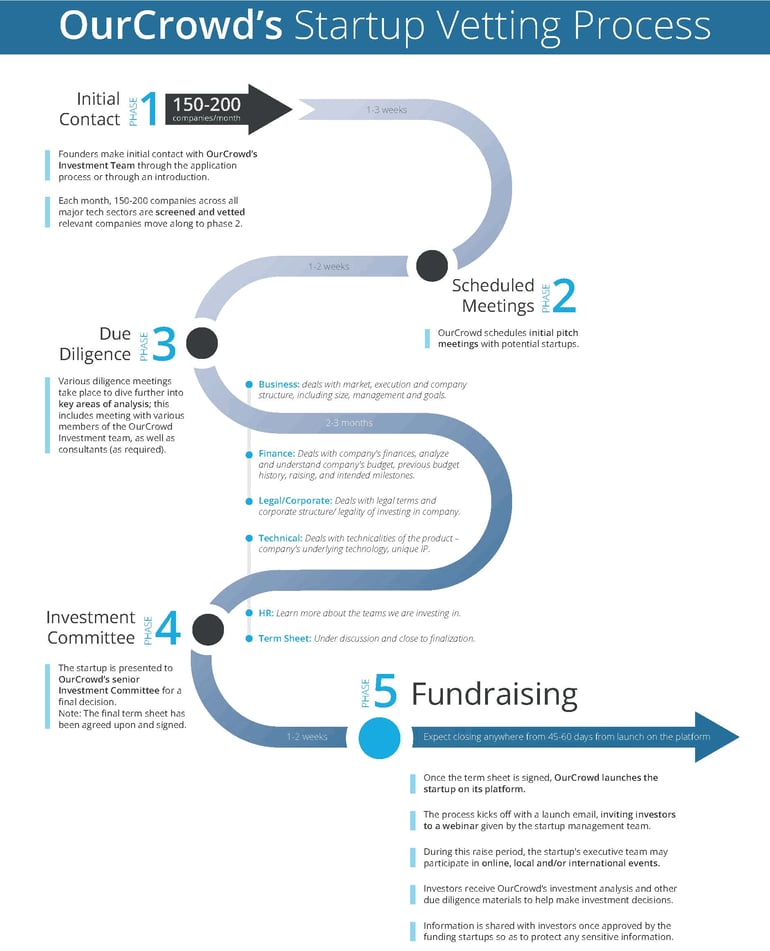

The expression page

From the context of startups, an expression page is definitely the primary conventional report from a startup founder and an buyer. An expression sheet lays out your terms and conditions for expenditure. It is accustomed to discuss the actual conditions, which can be then published up in a very commitment.

The downside of benefiting from funds

As soon as the expense, it’s not completely your own nowadays. That desire you had of building your individual organization comes to an end if you carry out out of doors startup traders. You have spouses now. One has people who have an insurance claim topossession and reveals, and having a sound in key judgements. You will no longer fixed your aims, method and milestones and pace.

Investors aren’t generic. Some come to be collaborative collaborators and also advisors, some are nagging insensitive experts. Some assistance, some don’t.

Investors may be managers. You will be not your human being if you have brokers you’re part of a team. You can not determine all the things all by yourself.

Investors never earn money until such time as there is a liquidity occurrence. That’s why we constantly speak about exit methods. You could end up the world’shealthiest and most joyful, most hard cash-independent provider, yet your investors will not be at liberty and soon you have them funds rear. The succeed gets cash back right out of the provider.

Founders should boost cash when they have identified what the market option is and who the purchaser is, and when they have sent a program that suits their is and requirements becoming adopted in an remarkably fast fee.

Hunt for solutions to hold how much home equity or rates only possible when negotiating through an buyer. For instance, ask for a small amount of money at first, rather than a amount you sense you’ll will need over a couple of years. This enables you to hand out a smaller portion from your enterprise to acquire the budget, so you have far more being the seller with the corporation.

Just what are the Alternatives?

If it is the recommendation you need over the financing, an alternative choice is to consider an associate ready to offer performing investment capital and experience towards your firm. You might have a lot more alternatives for terminating this deal.

Your companion can agree with sell off his portion of the alliance for your requirements, one example is. You then personal his reveal and you should not should pay a percentage in the sales to him ever again.

It was an additional strong thirty days for car startups, with one particular autonomous trucking organization in China attracting an immense $100M investment decision. Another sizzling location was optimization of product discovering deployments, like one particular new business launch. Quantum processing, etch devices, and mmWave element during this month’s evaluate 20-two startups that collectively elevated $375M.

It was an additional strong thirty days for car startups, with one particular autonomous trucking organization in China attracting an immense $100M investment decision. Another sizzling location was optimization of product discovering deployments, like one particular new business launch. Quantum processing, etch devices, and mmWave element during this month’s evaluate 20-two startups that collectively elevated $375M. Semiconductors And design

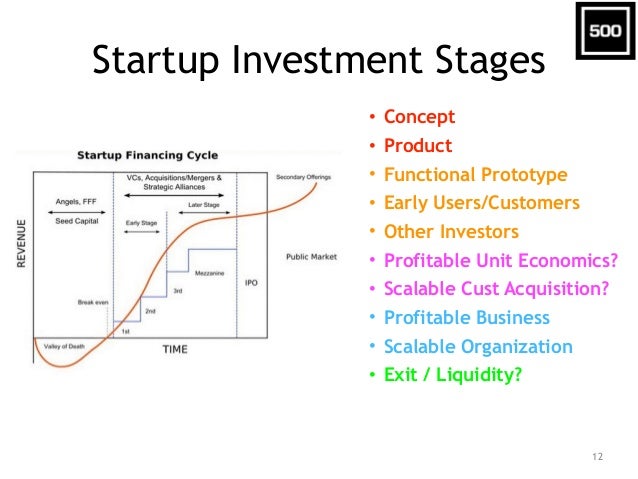

Semiconductors And design Investors can be called when during just about any step on the lifetime of a start-up. The following are several of the extremely frequent sorts of investors, and recommendations for when they will be regarded.

Investors can be called when during just about any step on the lifetime of a start-up. The following are several of the extremely frequent sorts of investors, and recommendations for when they will be regarded. Personal cost savings normally are available in two kinds: income and income-equivalent savings, and retirement bank account. Utilizing your particular savings may be practical. The required money is already available, and there is not any need to go into credit debt to generate it. The individual cost savings method can also be a tricky path to practice, having said that. In many cases, enterprisers search for brokers to begin with as their individual financial savings simply are not significant enough for demands. Additionally, it is individually tricky for many to gamble with money they will often in the future requirement for other uses, including pension, college capital because of their youngsters or individual obligations.

Personal cost savings normally are available in two kinds: income and income-equivalent savings, and retirement bank account. Utilizing your particular savings may be practical. The required money is already available, and there is not any need to go into credit debt to generate it. The individual cost savings method can also be a tricky path to practice, having said that. In many cases, enterprisers search for brokers to begin with as their individual financial savings simply are not significant enough for demands. Additionally, it is individually tricky for many to gamble with money they will often in the future requirement for other uses, including pension, college capital because of their youngsters or individual obligations.