Logo all set? Check.

Business concept completely ready? Check.

Congrats. You may have crafted a business.

But… put it off. Should it operate of this nature in the real world? No, it is not all pleasurable. Especially when you plan an authentic online business, issues are certain to get significant very swiftly.

To begin with your company, you need to get your idea to ideation, as well as that, you will need a Minimum Viable Product (MVP) that may be all set for that current market. You now are seriously interested in the business, you will want STARTUP FUNDING. Assuming that you are a clean scholar, just from the college, you will possess all over two or three hundred or so bucks… not even near something that might get your startup listed.

FYI: In the united states, the average cost for signing up an organization is approximately $800 to $1000. Well, another concern in your mind will probably be where by would you get cash?

Varieties of Funding for Startups Seed Funding for Startups

Series A

Series B

Tips to get backing for startups Crowdfunding

Angel Investors

startup investment, linked resource site, Incubators

Startup Accelerators

Pitching Competitions

Bank Loan

Relatives and buddies

Govt Grants/Programs

Bootstrapping

Where Will You Get Startup Funding?

Getting cash to your startup can be difficult, specially when there are no services or products to present. People will not believe that your plan. And, the bad headlines is you can not get backing to your new venture from anybody who is simply not even believing your concept.

So, what should you do?

You visit your family. In case your thought is deciding on garbage – trash can market as well [Actually, your mommy, your father, they can think you! ].

The fact is, leading company celebrities like Nick Woodman, Donald Trump, Kim Kardashian, Elon Musk, Jeff Bezos, and a lot more got cash off their mother and father if they were in the early steps of their own company. Later, they were able to turn this first funding for new venture into vast amounts of money for themselves, together with their household, with sheer perseverance and smart actions.

When you have funds through your loved ones, it is possible to make it to obtain a couple of years, But when you are out of that what do you do? Read down below.

Sorts of Startup Funding for Business

If your start up needs to make it through, it should undergo several rounds of money. Let’s understand how lots of rounds does a common startup experiences and why.

Seed Funding For Startups

Seed backing will be the initial start up funds you receive for your personal small business. It is usually approximately $50,000 or $500,000 depending on how persuasive business presentation you earn and the total amount you need to have to use your business off the ground. The thing is, this is just about the riskiest ventures.

Why?

Simply because you cannot establish that the organization will make it through. If it falters, they are going to lose their very own challenging-gained cash in many weeks.

For this article, we shall imagine that the start up will survive. And, if this does for around a couple of years, you may be qualified for get range A backing.

Series A

You are now out from funds. You may have offered a write about of ten percent on your father for those seed funding. Now, you need a lot more income to obtain items one levels up. You are going to connect to endeavor investment capital (VC) angel and firms investors to get additional investment. This particular purchase is quite a bit greater than everything you were aiming to begin with. It will work from two or three hundred or so 1000 us dollars to vast amounts of money. But you will need to give a promote of the company into the new buyers.

Let’s state that you brought 10% to the father throughout the seed funding. But now that you find more investment to arrive throughout the Series A funds, you should dilute the gives. Is how it works:

Initial corporation value = $300,000

Father’s share (seed financing) = $30,000 = ten percent

For Series A funding you get 1 million money from the VC business. Now the provider reveal will belike this:

Company benefit = $1 zillion + $300,000 + = $1.3million + posting-money importance = $ 3 mil

Note: You don’t have $1.7 million but you assume that by obtaining the financing for new venture from shareholders your company’s importance will increase.

Now you will good deal with VC organization to have 30% price in your provider for 1 mil buck money. Therefore, the start-up will relieve gives you, diluting the last discuss price.

Let’s presume there are 100,000 gives of your respective corporation, with each talk about really worth $3. Now, to present 30% on the company towards the new shareholders, the firm will discharge more gives. Your initial 100,000 offers will reduce right down to 70Per cent of the whole firm appeal. To finish it, you can discharge 42,857 more shares of 30Per cent company worth. The total number of new conveys is going to be 142,857. Additionally it means that the company’s talk about importance boosts to $21.

Therefore, your dad doesn’t keep 10% corporation price. But guess what? His discuss value has risen from $3 to $21. Hence, your father’s current discuss value is $210,000 as an alternative to $30,000 which he brought both of you years back.

Series B

Similarly, your organization can go with line B funding soon after four to five a lot of treatments – if it deems suitable. More often than not, providers never choose series B backing because they tend to grow to be money-making immediately after five years or thereabouts. This start up funding is typically in dual-digit mil stats starting up close to ten million for basic funds round.

Listed here is a summary of how startup financing proceeds. Watch the complete movie for more information regarding the things we have just spelled out.

10 Methods for getting Funding for Startup

Since you now figure out what is startup backing, and exactly how it will help give out fairness of every entrepreneur, let’s look into the “How to get money for startups? “

1. Crowdfunding for Startups

One method to get startup financing is through crowdfunding. Crowdfunding is regarded as the quickest and best methods for getting funds. Why? Since the audience is not going to have you give it back. They simply want the merchandise or perhaps the support which you offered to give. So, how does it go?

Well, check Kickstarter,Indiegogo and Patreon, and you will find that these are generally some crowdfunding resources that permit the audience to receive goods for financing the startup. Many reliable startups are getting to be successful making use of the crowdfunding strategy.

So, just how do you get crowdfunding?

Wil Schroter, the Founder and CEO of Startups.co, claims:

“And expand it after that. Should you be trying to increase $100K, begin with a $10K focus on. The reason is due to the fact receiving the very first slice of dedication is significantly tougher than the remainder of it. No one wants being the initial person into the celebration. In case you surpass $10K (or whichever your multitude is) you can grow following that. But think specifically about preliminary energy, then enlargement.”

Suggestions for Getting Crowdfunding

– Generate a fantastic system or prototype that solves problems

– Make video recording shots of the product’s use scenarios

2. Angel Investors

Angel buyers are private purchasers who commit in the seed money level. That’s why they are called ‘angels’ due to potential for selecting a new company is greater than regular. Seeking an angel trader for your company is fairly easy if you have the proper contacts. You will find them via your own personal network system, hunting on social websites sites then giving them your start-up pitch, or by going to startup activities.

Doreen Bloch of Poshly Inc, says:

“One of the key benefits of purchase, beyond the budget, may be the experience from the investors to aid move your online business forwards. Especially, angel investors will often have deeply sector practical experience, together with relationships which you can take advantage of for your business. I suggest searching for any exec-levels industry experts on the space who can carry more than solely a check to your dining room table in an angel cope, if your start up focuses on consumer research, expert sporting activities, Fortune 500s, the sweetness business, and so forth.”

Suggestions for Raising Angel Investment

– Build romantic relationships earlier and never wait for a perfect time to pitch. Who knows if you are finding the ideal option.

– Construct a strong system and acquire all the grip as you grow. Don’t go with buyers, permit them to come to you.

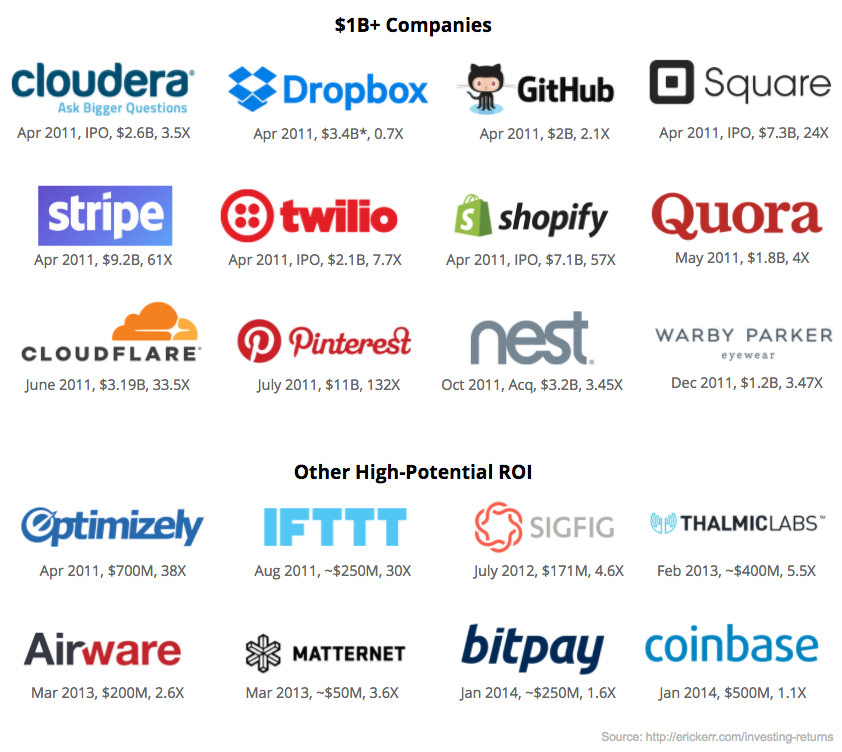

3. VC Firms

A Venture Capital Firm is actually a reduced relationship or very little accountability provider that invests in start-up enterprises with potential for an increased return on investment with regard to their swimming pool area of brokers. Most VC firms are make an effort to hunting for startups that want to get money in turn for collateral. But you can also get them right through their internet websites or via new venture activities. The ultimate way to locate VC companies is participating in start up pitching consultations. The best example of that is Shark Tank, in places you are likely to pitch for purchase to sharks within the aquarium.

Wade Foster of Zapier states:

“The the easy way purchase an trader anxious about your online business is to never need an individual to begin with. First, make a reliable system, then gather as much grip as you possibly can.”

Tips for Attracting VC Firms

– As stated before, produce a great product and VC companies won’t refute the application.

– The one thing VC firms see in the start-up is when they can get yourself a return of investment. These are generally there to dual-into their cash. They are delighted to spend.

4. Startup Incubators

Startup incubators never often want home equity except if also, they are giving some form of funds for startups. Usually, they just incubate and fully developed the startups so that they can pertain to the accelerator programs. The duration of incubation can vary from 3 months to your year or so. Most startup incubators offer mentorship, workplace, and in some cases aid startups meet up with angel purchasers. But, there are a few incubators that they like startups to obtain resources from their store in return for the share in the start up. Make sure to examine this while putting on there.

Angela Ruth of eCash, affirms:

“You’ll succeed in an accelerator method when you’re accessible to the advice with the authorities jogging the software program. Even though this simply means pivoting your start up or making important adjustments for your business design, it’s crucial to hear and think about what these specialists are saying. They also have the happenings and knowledge to help be sure that your strategy becomes a maintainable small business.”

Suggestions for Entering into a Startup Incubator

– Take a practical solution. Also, be offered to feedback from advisors.

– Make your network system with all the right folks. Get grip for the item.

5. Startup Accelerators

Consider an accelerator being the 2nd level of your new venture founder exercising. Before looking for 1, contemplate:

Must I even want an accelerator?

Maybe your new venture is to get grip itself, so you don’t really need to be inside an accelerator at all. Accelerators generally need to have a Minimum Viable Product (MVP). Therefore, construct an MVP initially. Also, ensure that your product is currently in the market. Most accelerators will decline the goods when it is not on the market. The fact is, unlike incubators, the accelerators are just for your fixed word and very mentorship-powered.

Education in accelerators is mainly seminar-established. You can enroll in the sessions slightly likewise like we provide mentorship periods at Cloudways Startup program.

Now will come the important problem. How could a new venture accelerators fund a startup online business? There are several accelerators that will allow the startups for getting cash from them in turn for fairness in the industry.

Sarah Corrigan, CEO of Leblum, affirms:

“Investors are looking at a large number of organizations. Boil everything because of the best, impactful one or two phrases.”

Tips to Join an Accelerator

– Accelerators only will demonstrate a desire for your start-up if you have gathered grip.

– Most accelerators may help you get connected to start up shareholders. Do ensure to provide a difficulty-managing item.

6. Pitching Competitions

Startupxplore, investment and funding for startups

startupxplore.com

We invest in tech startups that want to keep growing. You can invest with us and have access to great opportunities. We are waiting for you!

A good way to get funding on your new venture is from pitching competitions. Pitching tournaments are fantastic for people who are hoping to get feedback about their startups. Take shark tank, investors also known as sharks, offer funds for fairness from the start-up. To sign up in pitching events, start to look for new venture situations in your town and engage in them. You might need to pay off access expenses to penetrate in the pitching levels of competition.

Meridith Unger, the founder of Nix, affirms:

“One method of assessing no matter whether a pitch level of competition is well worth engaging in is replying to this: Should you lose, will the opposition assist you realize any of your goals, even? “

Methods for Entering Pitching Competitions

– The simplest way to enter in a pitching competition is to get an epic start-up notion.

– Next, invest in a simple however enticing pitching deck.

– Most pitching tournaments have a tendency to find distinctive suggestions. Aim to create creative thinking on your startup thought prior to pitching it during the competitive events.

7. Bank Loan

You can also go for loan company loans for your startup. Banks normally charge approximately 12Per cent to 15Per cent markup onto your dollars. You will need to place a guarantee prior to taking the money coming from the financial institutions also. This is often your house’s files or any other investment that is associated with you.

Your budget personal loan isn’t a good solution simply because, if for reasons unknown your startup fails, you may be still left with practically nothing, nor your business, nor your investment.

Benjamin Pimentel of Nerd Wallet states:

“Keep at heart that because you never have a enterprise commenced up however or you’re in the beginning stages, you probably ought to acquire income dependant on your own personal budget. This is why, you’re almost certainly going to be eligible for a new venture funding that has a robust personalized credit score.”

Techniques for Getting Bank Loan for your personal Startup:

– You can be entitled to a private loan considering that the business is however in the very first period.

And that means you will need to ensure that you do correct groundwork before applying to the personal loan.

8. Family and friends

Most organizations opt to get financing from close friends and family in the same way we highlighted in the example of this at the beginning. Funding from friends and family is recognized as seed financing. You will have to give them a percentage or number of your start-up collateral to take the money.

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

Expert Opinion

Martin Zwilling, a start-up advisor, suggests:

“Just like specialist buyers look forward to best freinds and family to go first, buddies will hang on for you to clearly show “skin from the game.” A start up founder who seems to be not the “lead investor” in time and expense, should not be expecting someone else to leap in the front and guide the way.”

Techniques for Getting Startup Funding from Family and friends

– Help it become professional: Document the responsibilities and outline money choices.

– Demonstrate your startup plan whilst keeping them briefed on a monthly basis.

9. Govt Grants / Programs

There are plenty of authorities permits in america for startups. But grants aren’t totally free. You can actually only get grants or loans for no-make money startups, in accordance with America.gov backing selections. For-make money startups, you can only get lending options in the USA. But living beyond the USA, you may get authorities permits.

Tips for Govt Grants

– The best way to submit an application for govt grants is to possess a arrange for your enterprise. You must establish a financial loan package together with the engaging financial institution. So, that if you default, the us government can pay to that person.

– Some government authorities have strict insurance policies about the quantity of people you have to have. Do make sure you read them.

10. Bootstrapping

This is certainly an individual alternative that we privately enjoy. Bootstrapping is designed for anyone who is willing to start off his or her own company. Bootstrapping usually means starting off your online business through your personal capital and tools, with no relying on any sort of outward resources. It truly is a fantastic way to continue to keep complete possession of your own start-up and turn into personal-based. But bootstrapping has its own downsides. If for reasons unknown the business will go bankrupt, your hard-earned income will disappear completely likewise.

Techniques for Bootstrapping

– Begin a aspect-gig to support your company.

– Ask your co-founders to swimming pool in most hard earned cash.

– Only commence this business when you find yourself completely positive one has money to have it living for the upcoming 36 months.

Should you like any one of these choices?

As you now understand about start up money forms and ways, it can be time to get started developing a small business thought that you may become actuality. While we don’t accentuate that you ought to start off like a bootstrapped online business, it usually is a sensible practice to hold the obligation to a minimum within the very first a great deal of your organization.

Was this post useful? Just how can we increase the amount of appeal to the articles and reviews? Let us know in the reviews listed below.

Related Article: Startup Pitch Deck 101: How To establish a Winning Pitch Deck For Startup

Even as most people are lapping inside the government’s 2Per cent rest in personnel provident fund (EPF) to avoid wasting cash, ESOPs are transforming right into a cost you-saving resource for startups plus a commitment of some reimbursement for workers over time.

Even as most people are lapping inside the government’s 2Per cent rest in personnel provident fund (EPF) to avoid wasting cash, ESOPs are transforming right into a cost you-saving resource for startups plus a commitment of some reimbursement for workers over time.

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed.

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed. Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts.

Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts. That lots of startups are unable to but show a turn over, and they ordinarily depend on equity financial investment for cash flow, excludes most from the Coronavirus Business Interruption Loans Scheme (CBILS).

That lots of startups are unable to but show a turn over, and they ordinarily depend on equity financial investment for cash flow, excludes most from the Coronavirus Business Interruption Loans Scheme (CBILS).

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

First, your online business approach and phone numbers are most likely improper. Don’t use it individually, their viewpoint is dependent on practical experience. Second, it’s going to require a lot more than you might be estimating for getting one thing to advertise.

First, your online business approach and phone numbers are most likely improper. Don’t use it individually, their viewpoint is dependent on practical experience. Second, it’s going to require a lot more than you might be estimating for getting one thing to advertise.

The leading causes of disaster change from absence of company experience to malfunction to measure the industry to setting up a bad supervision staff. But above all, cashflow complications cripple a lot more startups than every other point.

The leading causes of disaster change from absence of company experience to malfunction to measure the industry to setting up a bad supervision staff. But above all, cashflow complications cripple a lot more startups than every other point.