For the best up-to-date details and news in regards to the coronavirus pandemic, go to the WHO internet site.

For the best up-to-date details and news in regards to the coronavirus pandemic, go to the WHO internet site.

Cecilia Ng and her partner were going back to San Francisco in March, after a getaway to memorialize her 40th bday, when murmurs of layoffs set about getting louder. A recruiter at Sonder, a condo hire start up, Ng already possessed a perception that the marketplace approximately America was getting good precarious each day because the financial disaster due to the coronavirus was becoming sharper.

Before she left on which has got to be two-week trip in Colombia, devoted having sea food, exploring the convent-switched-resort the place she was engaging in and keeping yourself some shore studying about Buddhism and reflection, her leaders at Sonder obtained available workers reassurance.

But within just twenty-four hours of coming back home, Ng was outside of employment, in addition to about 400 other furloughed and placed-off co-workers. Health care positive aspects until the conclude of your thirty days and had a couple of hours to remove personal records from her work notebook right before she was secured out.

They requested us not to contact co-workers,” Ng explained,

“Because they communicated every day. The call when her leader let her go survived 10 minutes.

Ng wasn’t all alone. In excess of 33 thousand men and women have applied for preliminary unemployment statements during the past six many days, an financial crisis spurred by initiatives to include the coronavirus, that has contaminated in excess of 3.7 million and brought the life in excess of 264,000 individuals around the globe. In April, the US employment market tallied its most detrimental thirty days on track record, through an unemployment amount of 14.7%, up from 4.4% in March.

But as Ng quickly identified, there’s been an uptick in task availabilities in Silicon Valley in the last few months. She could get a new posture within just underneath 3 many days for a techie recruiter at Robinhood, the company right behind a similar-given its name application for inventory forex trading.

CNET Coronavirus Update

Monitor the coronavirus pandemic.

Despite the pandemic and looming financial bad times, a great deal of the technological marketplace will continue to blog post task item listings and retain the services of employees. Many businesses are even preparing to continue presenting summer time internships, though having a work-from-household style. Amazon, Microsoft and The apple company each one list at the very least 2,000 opened work opportunities on his or her respective web sites, plus the organizations all say they’re nevertheless employing. Google has mentioned it’ll lessen expenditure in new hires through out the year, in part because of slowdown in promoting sales. Facebook, also hit by an ad crunch, stated it offers to work with ten thousand persons throughout its tech and system crews in 2020.

The San Francisco Bay Area, house to Apple, Salesforce, Netflix, Twitter and Yahoo and google, notched 17% development in new work opportunities shared in March from the same time frame last year, as outlined by data created by career web site Monster. Along with the US Department of Labor claimed during the full week finished May 2, California discovered one of the greatest droplets in new joblessness promises in the united states.

There are actually outliers like Uber, Airbnb and Lyft, stated Jonathan Beamer, Monster’s travel of marketing. Tens of many people are purchased to shelter in place to slow the propagate in the coronavirus, pushing holiday-associated technology organizations to put out of thousands of employees. But technician firms, Startup Investment in particular the greater people, seem ready to grow their workforces in lieu of reduce in size them.

“The technological sector is just continuing to move forward,” Beamer reported.

The comparatively rosy picture for significant computer further more demonstrates our escalating reliance on many of the most significant competitors once we weather condition this lockdown. It’s also in stark comparison to your scenario confronted by the rest of the entire world, the spot that the coronavirus pandemic has forced the closure of organizations and also the cancellation of situations saved persons from journey and perhaps for the short term close the doors to Disneyland. Scientists are racing to find a remedy and produce a vaccine for any malware.

Apple was one of the primary technical titans to caution that its business will be interrupted. In February, after it saw manufacturer disruptions and profits decrease in China, in which the coronavirus is believed to own started, the business claimed product sales appeared prone to slip. Nearby authorities in the usa started off issuing continue to be-at-property orders, shutting nonessential corporations.

The end result: Many individuals furloughed or laid off are competitive for a lesser number of obtainable work. pleasure, Disciplines, childcare and tourism employment listings have fallen at least 50Percent up to now this year, as outlined by records gathered via May 1 by job opportunities site Indeed. business banking, Engineering and development, at the same time, have been a lesser amount of influenced but have noticed spectacular dropoffs. Software advancement has viewed a number of the smallest declines, but listings remain lower just about 33Per cent, Indeed explained.

Coronavirus changes

The possibilities of another stimulus verify

Can’t locate experience face masks you like? Purchase them online

Obtain your Disney theme park fix in your own home

News flash, more and advice about COVID-19

Though some jobs in tech property could possibly be disappearing, organizations such as Amazon and Instacart have released using the services of sprees that’ll obtain them adding 175,000 and 300,000 workforce, respectively, to aid take care of industrial environments and deliveries as people today just click to order from your own home. All that adds up to technician providers possibly developing their in general share of employees in the united states, bolstering their currently extensive affect in people’s day-to-day lives.

“In case you have Amazon and Instacart employing hundreds of thousands of persons though millions of people reduce their careers, computer will end up a substantially more substantial element of the financial state,” stated Bob O’Donnell, an analyst at Technalysis Research.

Startup slowdown

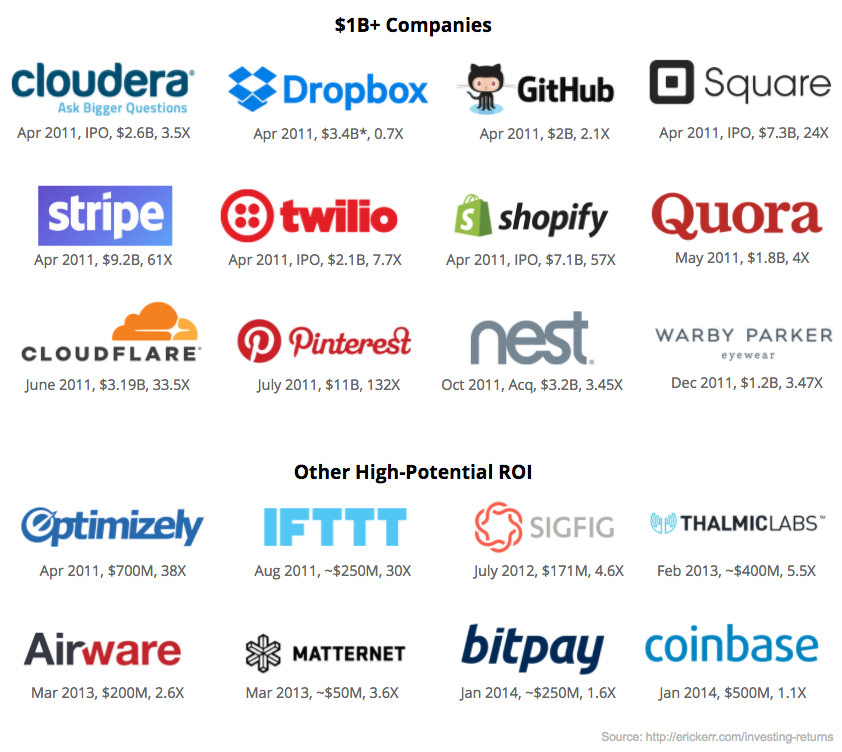

Not everyone is growing, though the larger technological business could possibly be succeeding. Startups are going to be cautioned they might struggle to bring up new funds, which could suggest a cutoff of center to businesses that haven’t yet perfected their solution or built an ample amount of a small business to achieve success alone.

“Coronavirus is the black colored swan of 2020,” started a March letter from Sequoia Capital, brought to CEOs and creators it dedicated to. The significant enterprise company, known for earlier investment strategies in Apple, The search engines, YouTube and LinkedIn, offered referrals to providers on how to browse through the turmoil.

Sequoia urged firms to make for sales to crumble and funding to dried out up. Companies should also reconsider which staff members to maintain on as well as how significantly they’re shelling out for promoting.

“An original attribute of long lasting companies is the way their market leaders respond to events such as these,” the letter mentioned.

Since that notice, choosing appears to have slowed down during the new venture environment. “They’re tightening up,” reported Jill Hernstat, a recruiter at professional lookup business Hernstat & Co.

By way of example, Hernstat recognized, hot startup investment TripActions, a creator of commercial traveling application, fired a huge selection of workers in March and stopped hiring, taking away all open up job listings on its internet site. At that time, this company, valued at $4 billion dollars prior to when the uncertainty, advised The Wall Street Journal that it really has profit the lender. However with journey just about fully halted, TripActions mentioned, it got decided to shrink its investing and labor force to give them “inline with all the present weather.” (TripActions didn’t respond to a request comment.)

LinkedIn, the project-focused social media, mentioned it’s also noticed a shed in task postings at startups. It mentioned that involving unicorn businesses (those worth more than $1 billion dollars), employment listings in March have been barely fifty percent whatever they were definitely in the course of current highs survive July.

“Coronavirus is definitely the dark colored swan of 2020.”

Sequoia Capital note to creators and CEOs

Not all of the technical firms are affected exactly the same. Unicorns concentrating on component, traveling, health and instruction have observed career listings drop a lot more than 40Per cent, LinkedIn explained. But businesses concentrating on man made communications, intelligence and cybersecurity have risen employment results by ten percent or even more. Robinhood, the inventory investing mobile app Ng works for, claimed it’s employed 100 employees considering that transitioning to isolated function in March, and also it intentions to add more hundreds more by year’s ending.

Understanding Startup Investments | FundersClub

fundersclub.com › learn › guides › startup-equity-investments

And money. This is where startup investors come in. In Silicon Valley and beyond, early-stage startups can raise venture capital from VC firms and angel investors …

Larger technological companies that aren’t traveling-similar is likely to weather conditions the hurricane a lot better than most, said Andy Challenger, mature vice president at Challenger, Gray And Christmas, an outplacement and professional-teaching firm.

One advantage is usually that employees will be able to do the job anyplace, due to the fact their work center around laptops or computers. These organizations also tend to have more radiant people, who are unlikely to obtain preexisting health conditions that might make coronavirus deadlier to them. But Challenger nevertheless wants the fact that industry will battle alongside many others.

If you’re a Silicon Valley technology business or simply a producer during the oxidation buckle, uncertainty helps make operating very difficult,” Challenger stated.“It doesn’t matter>

Recruiting improvements

Many leading Silicon Valley organizations, for example Apple, Google and Fb, notoriously expect workers to be found in to the place of work, even if this would mean enduring grueling hours-longer commutes. That perspective is beginning to change despite the fact that, as employees force to get more-accommodating work hours whilst they’re taking good care of children your home from education or relatives kicked out of nursing homes.

The pandemic is additionally transforming how organizations work their once a year internship and sponsoring plans. Apple mentioned its internship plan continues, within both-guy and digital, in excess of one thousand university students this season. The iPhone creator intentions to pay them the identical that it has in decades past, way too.

“We feel it’s essential to retain this pipeline of prospect really going, and we will increase for our interns precisely the same proper care and safeguards that we’re stretching out to everyone our other personnel as a part of the continuing COVID-19 solution,” an Apple spokesperson explained.

Facebook will switch its intern class on-line, trying to keep approximately precisely the same variety of university students and shelling out them much like in past times, while it dropped to disclose people numbers. Microsoft stated its intern course is going to be larger this year, topping 4,000 college students, by way of a electronic software. Twitter may have a smaller class, plus the software is going to be solely on the internet likewise. Not in their income department, and apprenticeships are postponed, however pinterest in a similar fashion can provide internships. Airbnb, however, canceled its intern system totally this season, although it have give a 2021 internship to the people it had already determined.

Beast tallied of a 70Per cent decline in internships throughout the US so far this holiday season.It’s hard to tell just how many tech internships happen to be affected by the COVID crisis>

“Having interns typically takes loads of work just to buy them as much as quickness and locate them a persuasive task,” said Shannon Schiltz, go of HR and individuals strategies and operating mate at project business Andreessen Horowitz, recognized for its investments in Facebook, Twitter, Oculus VR along with the preferred on-line activity Roblox. Students don’t just miss out on an internship within a certain company as well as a opportunity in a possibilities career, she put in. Not needing an internship “potentially bleeds into interns obtaining tasks as being a college grad inside the right after 12 months.”

“We believe it’s crucial that you always keep this pipeline of prospect moving.”

An Apple spokesman

Dell restructured its internship program for more than 900 university students in the usa in March. It forwarded a observe to everyone its interns, describing which the program could be digital, they’d remain paid and the length might be 9 2 or 3 weeks rather than the regular 11 or 12.

Dell also mentioned options for instructing all the interns the company’s software program advancement operations, and providing a schedule of societal work and gatherings jobs that’ll improve their abilities. Following the method wraps up, Dell plans to employ a few of the interns after the summertime, as it has in years past.

“They’re revealing us they desire expertise growth and establishing,” explained Jennifer Newbill, Dell’s director of university hiring. “We need to be sure they learn a ability.”

Ng, the recruiter at Robinhood, was used to having LinkedIn requests from learners seeking a career. But now, she explained, seasoned computer software engineers who might not have replied to her overtures last year are going to her instead. She recalls curious about if she should wait out the fiscal interruption, and no matter if any new career would be superior to the person she’d just lost.

Watching many people losing their jobs, she’s happy she observed one. “There’s destined to be this downstream impact on the field, meaning more accomplished men and women are sure to occur in the market,” she said.

Nevertheless it appears they’ll locate a task. At the moment.

Now taking part in: Watch this: Fired Amazon personnel accuse corporation of retribution

Last year was essentially the most successful year or so of fundraising by African technological startups>

Last year was essentially the most successful year or so of fundraising by African technological startups> Greycroft Partners is usually a US-established endeavor budget firm which mostly invests in virtual computer and multimedia startups. In line with Lot of money, they target ahead of time-stage companies with fresh creators, generally in “seed” or “Series A” rounds. As reported by the exact same review, they have a keen desire for startups that happen to be going by girl business people and creators. They recently bought a Kenyan bitcoin payment BitPesa, Nigerian and remedy fee option, Flutterwave. They already have two resources available: Greycroft IV, a $204 thousand opportunity fund and Greycroft Growth II, a $365 zillion expansion-level account. Greycroft Growth II begins at $10 million and definitely will spend up to $35 thousand within a company.

Greycroft Partners is usually a US-established endeavor budget firm which mostly invests in virtual computer and multimedia startups. In line with Lot of money, they target ahead of time-stage companies with fresh creators, generally in “seed” or “Series A” rounds. As reported by the exact same review, they have a keen desire for startups that happen to be going by girl business people and creators. They recently bought a Kenyan bitcoin payment BitPesa, Nigerian and remedy fee option, Flutterwave. They already have two resources available: Greycroft IV, a $204 thousand opportunity fund and Greycroft Growth II, a $365 zillion expansion-level account. Greycroft Growth II begins at $10 million and definitely will spend up to $35 thousand within a company. Investors is usually termed on through any type of phase in the lifetime of a new venture. Take a look at five extremely frequent varieties of traders, and strategies for when they will be viewed as.

Investors is usually termed on through any type of phase in the lifetime of a new venture. Take a look at five extremely frequent varieties of traders, and strategies for when they will be viewed as. Personal price savings normally are available in two kinds: dollars and money-similar price savings, and retirement credit accounts. Making use of your private discounts can be beneficial. The essential money is currently accessible, and there is not any will need to go into debt to acquire it. However, the personal financial savings solution might also be a tough method to focus on. Very often, internet marketers try to find investors to start with because their unique financial savings merely aren’t sizeable sufficient because of their demands. Additionally it is individually complicated for lots of people to risk with hard earned cash they will often later requirement for other purposes, such as retirement life, higher education money for their youngsters or individual financial debt.

Personal price savings normally are available in two kinds: dollars and money-similar price savings, and retirement credit accounts. Making use of your private discounts can be beneficial. The essential money is currently accessible, and there is not any will need to go into debt to acquire it. However, the personal financial savings solution might also be a tough method to focus on. Very often, internet marketers try to find investors to start with because their unique financial savings merely aren’t sizeable sufficient because of their demands. Additionally it is individually complicated for lots of people to risk with hard earned cash they will often later requirement for other purposes, such as retirement life, higher education money for their youngsters or individual financial debt. Facebook’s pursuit to join the entire world is area of the company’s content at MWC in Barcelona for a long time now. But since the clearly show was canceled this present year on account of problems over the coronavirus outbreak, the business is pushing onward featuring its newest connectivity revisions. On Tuesday, Facebook produced quite a few announcements about its lots of projects intended to bring economical internet connection to folks in creating nations around the world and rural parts.

Facebook’s pursuit to join the entire world is area of the company’s content at MWC in Barcelona for a long time now. But since the clearly show was canceled this present year on account of problems over the coronavirus outbreak, the business is pushing onward featuring its newest connectivity revisions. On Tuesday, Facebook produced quite a few announcements about its lots of projects intended to bring economical internet connection to folks in creating nations around the world and rural parts.