For the best updated headlines and information regarding the coronavirus pandemic, visit the WHO web page.

For the best updated headlines and information regarding the coronavirus pandemic, visit the WHO web page.

Cecilia Ng and her man were definitely going back to San Francisco in March, after having a vacation to enjoy her 40th birthday bash, when murmurs of layoffs began getting even louder. A recruiter at Sonder, a flat rental new venture, Ng currently got a feeling the fact that marketplace close to America was getting good precarious every day as being the global financial disaster caused by the coronavirus was being much better.

Before she still left on the would have been a two-weeks time escape in Colombia, expended ingesting sea food, checking out the convent-switched-lodge where by she was staying and accomplishing some beach front looking at about relaxation and Buddhism, her managers at Sonder possessed offered staff members reassurance.

But within just twenty-four hours of coming back home, Ng was from work, as well as about 400 other laid and furloughed-off fellow workers. Healthcare rewards up until the ending with the thirty day period and had several hours to clear out particular data from her do the job notebook prior to she was secured out.

“Given that they conveyed throughout the day, they inquired us to never talk to peers,” Ng stated. The phone call in which her employer let her go survived 10 minutes.

Ng wasn’t all alone. More than 33 zillion people have requested original joblessness claims during the past 7 months, an financial crisis spurred by hard work to contain the coronavirus, which has affected more than 3.7 thousand and brought the lives of over 264,000 folks over the world. In April, the US employment market tallied its most awful thirty day period on history, by having an joblessness fee of 14.7Per cent, up from 4.4Percent in March.

But as Ng in the near future learned, there’s been an uptick in career openings in Silicon Valley over the past month or two. She managed to find a new position in barely below 3 days like a specialised recruiter at Robinhood, the business powering a similar-branded application for stock exchanging.

CNET Coronavirus Update

Account for the coronavirus pandemic.

Inspite of the pandemic and looming economic depression, a lot of the technology market continuously article task item listings and hire staff. With a do the job-from-home style, although some companies are even intending to go on featuring summer months internships. Microsoft, Amazon . com and Apple inc every collection at the very least 2,000 open work opportunities in their respective sites, along with the providers all say they’re continue to getting. Google has reported it’ll minimize financial investment in new hires for the remainder of the season, partly as a result of slowdown in promoting sales. Facebook, also attack by an ad crunch, stated it offers to use 10,000 men and women all over its tech and item groups in 2020.

As outlined by details created by career web-site Beast,

The San Francisco Bay Spot, the place to find Apple company, Netflix, Twitter, Salesforce and Google and yahoo, notched 17Per cent increase in new jobs posted in Mar from once this past year. And the US Department of Labor reported within the full week ended May 2, California discovered one of the primary falls in new joblessness claims in the united states.

You can find outliers like Airbnb, Uber and Lyft, claimed Jonathan Beamer, Monster’s go of marketing. Tens of many people happen to be ordered to shelter in position to slow-moving the propagate with the coronavirus, compelling journey-associated technology organizations to put away from thousands of personnel. But technician organizations, particularly the larger players, appear ready to increase their workforces in lieu of reduce in size them.

“The technological industry is just continuing to move forward,” Beamer claimed.

The somewhat rosy picture for huge computer further more illustrates our developing addiction to most of the biggest players because we weather conditions this lockdown. It’s also in stark comparison on the problem dealt with by the rest of the society, the spot that the coronavirus pandemic has pressured the closure of companies and also the cancellation of gatherings maintained folks from holiday and in some cases for the short term close the entrance doors to Disneyland. Scientists are racing to identify a remedy and produce a vaccine for that malware.

Apple was one of the first technician titans to alert that its company could be interrupted. In February, after it found factory interruptions and sales lower in China, the place that the coronavirus is believed to obtain was created, the company mentioned profits appeared very likely to autumn. By the middle of-March, neighborhood authorities in the usa began issuing be-at-residence instructions, closing nonessential enterprises.

The end result: Lots of people furloughed or laid off are competing for less on the market careers. In accordance with info collected by May 1 by job website Definitely, amusement, tourism, Disciplines and childcare work listings have fallen at the least 50% so far this season. banking, Building and Startup investors production, on the other hand, are significantly less infected but nonetheless have experienced spectacular dropoffs. Listings will still be decrease close to 33Percent, Certainly reported.

Coronavirus upgrades

The prospect of the second stimulus examine

Can’t find deal with face masks you prefer? Have them internet

Get your Disney amusement park resolve in the home

News, assistance and more about COVID-19

Though some work opportunities in technical territory may be vanishing, companies including Amazon and Instacart have announced getting sprees that’ll see them placing 175,000 and 300,000 personnel, correspondingly, that will help take care of warehouses and shipping as folks click on to order out of your home. The only thing that adds up to technical providers possibly rising their general promote of individuals in the country, bolstering their already considerable influence in people’s lifestyles.

“In case you have Amazon and Instacart getting tens of thousands of folks when many people get rid of their careers, technician will become a far greater portion of the financial system,” stated Bob O’Donnell, an analyst at Technalysis Research.

Startup slowdown

The bigger computer industry could possibly be doing well, but few are flourishing. Startups are going to be aware they may struggle to elevate new cash, which might really mean a cutoff of center to firms that haven’t yet still mastered their product or service or made enough of a small business to achieve success independently.

“Coronavirus will be the dark-colored swan of 2020,” started a March note from Sequoia Capital, provided for founders and CEOs it purchased. The influential enterprise business, noted for beginning investment strategies in Apple, YouTube, LinkedIn and Google, presented referrals to organizations on how to browse through the uncertainty.

Sequoia urged companies to arrange for profits to crumble and lending to dry out up. Companies should likewise reconsider which employees to help keep on and the way very much they’re spending on promoting.

“A distinctive aspect of enduring corporations would be the way their market leaders respond to events such as these,” the notice stated.

Since that forewarning, hiring seems to have slowed down on the startup environment. “They’re tightening up,” said Jill Hernstat, a recruiter at executive look for strong Hernstat & Co.

For instance, Hernstat recognized, popular new venture TripActions, a maker of company vacation program, fired many personnel in March and discontinued using the services of, getting rid of all start occupation sale listings on its internet site. Right at that moment, the firm, priced at $4 billion until the problems, shared with The Wall Street Journal that it has funds in your budget. Although with journey just about completely halted, TripActions claimed, it experienced chose to get smaller its work force and spending to bring them “inline along with the up-to-date climate.” (TripActions didn’t respond to a request for review.)

LinkedIn, the duty-driven social media, mentioned it’s also spotted a drop in task listings at startups. It mentioned that among unicorn companies (all those valued at much more than $1 billion), career postings in March had been hardly 1 / 2 anything they have been during latest levels final July.

“Coronavirus is definitely the black color swan of 2020.”

Sequoia Capital letter to CEOs and founders

You cannot assume all technological providers are affected the same way. Unicorns focusing on health and wellbeing, component, holiday and training have experienced job postings decline more than 40Percent, LinkedIn stated. But businesses that specializes in unnatural communications, learning ability and cybersecurity have increased job postings by ten percent if not more. Robinhood, the supply buying and selling mobile app Ng works well with, claimed it’s recruited 100 staff members considering the fact that transitioning to remote are employed in March, and yes it intends to add thousands more by year’s end.

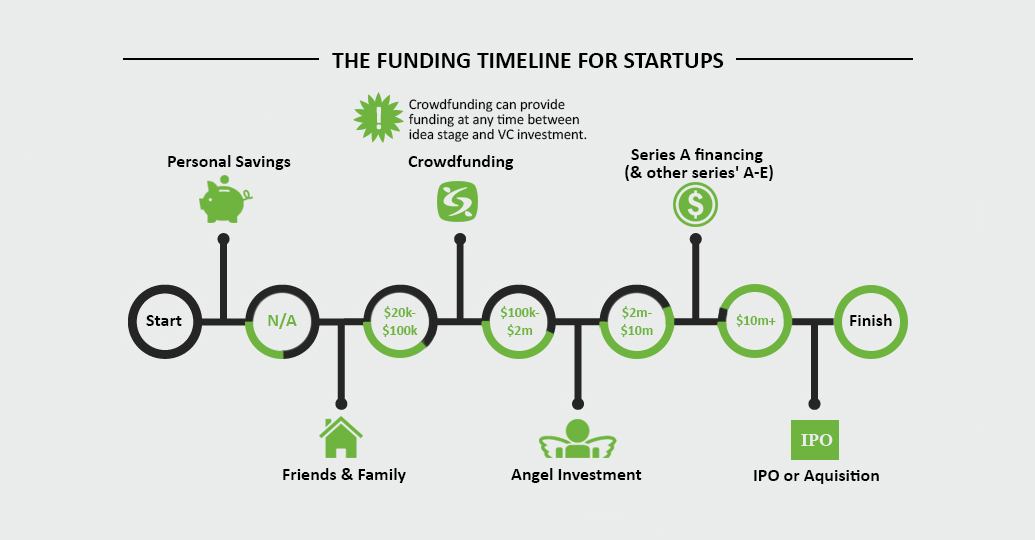

Understanding Startup Investments | FundersClub

fundersclub.com › learn › guides › startup-equity-investments

And money. This is where

startup investors come in. In Silicon Valley and beyond

, early-stage startups can raise venture capital from VC firms and angel investors …

Larger technician firms that aren’t vacation-related will in all probability climate the hurricane better than most, mentioned Andy Challenger, elderly vice president at Challenger, Gray & Christmas, an outplacement and exec-coaching company.

People will be able to work anyplace, considering the fact that their work center around computing devices,. That could be

An individual benefit. These organizations also usually have more youthful personnel, that are lower the probability that to possess preexisting health issues which could create the coronavirus deadlier for the children. But Challenger still is expecting the market will battle alongside other people.

If you’re a Silicon Valley tech provider or even a supplier inside the corrosion belt, doubt will make doing business very hard,” Challenger claimed.“It doesn’t matter>

Recruiting changes

Many top Silicon Valley businesses, for example Apple, Facebook and Google, notoriously expect personnel to arrive within the company, regardless if this means enduring grueling a long time-extended commutes. That frame of mind is start to change although, as people force for much more-adaptable working hours though they’re attending to young children your home from college or family kicked out of nursing facilities.

The pandemic is likewise changing how corporations work their annual internship and enrolling programs. Apple reported its internship program will continue, both in-guy and online, more than 1,000 individuals this season. The iPhone manufacturer offers to spend them the same that this has in many years past, very.

“We know it’s important to keep this pipeline of chance heading, so we will extend to our interns a similar safe practices and maintenance that we’re increasing for all our other staff members as part of the continuous COVID-19 result,” an Apple spokesman mentioned.

Facebook will transfer its intern category online, keeping close to the exact same variety of university students and shelling out them just like previously, although it dropped to make known individuals numbers. Microsoft claimed its intern class is going to be much larger this current year, topping 4,000 students, using a internet plan. Twitter will have a lesser group, along with the plan are going to be entirely via the internet also. Pinterest in the same way will provide internships, even though not in their profits department, and apprenticeships have already been postponed. It performed provide a 2021 internship to those it acquired presently picked out.

Monster tallied in regards to a 70Percent fall in internships over the US to date this holiday season.It’s tricky to convey to just how many technical internships have been impacted by the COVID crisis>

“Having interns often takes lots of operate only to get them nearly speed and locate them a engaging task,” mentioned Shannon Schiltz, top of your head of HR and people routines and operating partner at business organization Andreessen Horowitz, renowned for its assets in Facebook, Twitter, Oculus VR as well as the well-known on-line sport Roblox. Students don’t just lose out on an internship at the certain organization as well as a prospect at the possible job, she added. Without having an internship “likely bleeds into interns getting employment as being a university or college grad on the pursuing year or so.”

“We think it’s essential to retain this pipeline of program really going.”

An Apple spokesman

Dell restructured its internship process more than 900 individuals in the usa in March. It delivered a note for all its interns, presenting that the process could be digital, they’d certainly be compensated along with the timeframe would be 9 months instead of the normal 11 or 12.

Dell also reviewed ideas for teaching the many interns the company’s program growth techniques, and providing a routine of sociable functions and function jobs that’ll improve their capabilities. Right after the system wraps up, Dell offers to retain the services of a number of the interns at the conclusion of summer, since it has in many years prior.

“They’re showing us they desire competency growth and creating,” explained Jennifer Newbill, Dell’s director of college or university recruiting. “We desire to be certain they study a proficiency.”

Ng, the recruiter at Robinhood, was adopted to becoming LinkedIn demands from students hunting for a employment. However, she explained, encountered software programs technicians who might not have replied to her overtures a year ago are reaching her as an alternative. If she ought to hang on out of the fiscal dysfunction, and whether or not any new job would be a lot better than usually the one she’d just lost.

Watching people dropping their work opportunities, she’s thankful she uncovered 1. “There’s likely to be this downstream affect on the market, which suggests additional qualified persons are sure to can come to the marketplace,” she mentioned.

But it surely seems they’ll manage to find a job. Right now.

Now enjoying: Watch this: Fired Amazon workers accuse firm of retribution

9: 05

In May 2016, a regulations needed result which allows a person to commit at the least a selection of their money in startup investment (

In May 2016, a regulations needed result which allows a person to commit at the least a selection of their money in startup investment (

Facebook’s mission to join the earth has long been part of the company’s information at MWC in Barcelona for quite some time now. But even though the show was canceled this coming year because of problems over the coronavirus outbreak, the corporation is hitting ahead with its latest connection up-dates. On Tuesday, Facebook designed several announcements about its several jobs built to provide affordable internet access to folks in developing countries around the world and outlying areas.

Facebook’s mission to join the earth has long been part of the company’s information at MWC in Barcelona for quite some time now. But even though the show was canceled this coming year because of problems over the coronavirus outbreak, the corporation is hitting ahead with its latest connection up-dates. On Tuesday, Facebook designed several announcements about its several jobs built to provide affordable internet access to folks in developing countries around the world and outlying areas.

For the best updated headlines and information regarding the coronavirus pandemic, visit the WHO web page.

For the best updated headlines and information regarding the coronavirus pandemic, visit the WHO web page.

Investing start-up guideline

Investing start-up guideline