Founder presentations kicked-off and away to an incredible focus on a wide selection of 16 startups from SaudiArabia and Egypt, United Arab Emirates and startup investors Jordan. The demonstrations were actually followed by a panel of popular shareholders who provided key ideas into industry tendencies, and Misk500 Batch 1 graduates who offered significant marketplace sessions.

Previous to Demo Day, startup investors occasions company Eventtus produced exclusive routes for the 500 Startups App for each startup investors (Our Web Site) to have interaction with attendees and promote demo video clips, workforce bios and more.

Previous to Demo Day, startup investors occasions company Eventtus produced exclusive routes for the 500 Startups App for each startup investors (Our Web Site) to have interaction with attendees and promote demo video clips, workforce bios and more.

Commenting over the affair, startup Investors Sharif El-Badawi stated: “We are happy to have effectively hosted an wonderful and interesting 1-of-a-sort Demo Day. Their strength and willpower can be a proof of the strength of these creators and it is our true joy introducing those to a record quantity of universal, regional and localised substantial-report target audience from the entrepreneurial ecosystem.

It turned out to be an edge, even though

“Holding trial time on the electronic scope became a struggle. More participants involved with founders than we required. We expect with certainty to discover good relationships arrived at fruition in the near future. It can be noticeable that corporations offer you essential options which can be adapted on the greater technologies planet.”

500 Startups released The Misk500 Accelerator in collaboration with Misk Innovation in January 2019. The course allows beginning period technology companies scale. Founders gain access to a dedicated Entrepreneur in Residence, 1-on-1 mentoring with profitable creators, pitch teaching, expense readiness software programs, entrepreneur introductions, along with the 500 Falcons workforce. Thus far, 53 pre-seed and seed period startups spanning three batches have graduated in the process with a lot of them having currently brought up cash to degree their small business to a higher level.

The 16 impressive startups that participated in Digital Demo Day include things like:

Ajeer: an on-demand industry attaching house owners with dependable upkeep providers at aggressive amount of high quality and cost.

Appgain: is SaaS that can help portable advertisers have more consumers and increase preservation in a solo platform.

Bankiom: is computerized bank that allows you to available a current profile to get released an online credit card, on the cell phone… in 3 a few minutes or a smaller amount!

Bondai: is definitely the 1st market that will help crew tourists to find out and publication curated experiences in Saudi Arabia.

Circle: is usually a mobile iphone app enabling property or home supervisors to higher indulge using their renters, handle their requests minimizing business prices.

Coveti: produces entry row manner in your home with a mouse click.

DigitaSport: is SaaS that helps sporting activities groups and leagues build their particular mobile application to engage with regards to their admirers inside and outside spots.

ElCoach: an on-requirement physical fitness app for MENA. We use AI to produce customized workout and nourishment options-exclusive to every single end user-according to their up-to-date data, training session tastes, and overall health goals and objectives.

Elva: is the only absolutely remote control medicine management and watching alternative with 7 given patents which will work with any active medications.

Johrh: may be the major on the net abaya store on the GCC, marketing an array of high quality designs at the best prices.

MWJ: is a market place to purchase new and pre-held authorized deluxe wrist watches in Saudi Arabia.

Tammwel: is the best internet entrance to get the best personalised financial loans for all of your demands with instantaneous agreement selection.

Tasaira: is really a mobile software which enables Saudi motorists get personalized estimates from respected restore outlets.

Wee: would be the primary Saudi service provider for electric powered scooter sharing services.

Wuilt: can be a internet site contractor where you can make your very own Arabic site within 5 minutes.

Yovza: is SaaS that will help development firms from the MENA location digitize their approval work-flow just to save 70Per cent in their time And attempts at present included.

-Ends-

For every more info, you should contact:

Neena Punnen

500 Startups MENA

Email: neena.punnen@500startups.com

About 500 Startups:

500 Startups is often a world-wide early on period venture investment capital company over a pursuit to explore and back again the world’s most qualified entrepreneurs, help them to generate effective businesses at size, and make flourishing world-wide ecosystems. It is just about the most energetic project cash firms on the planet.

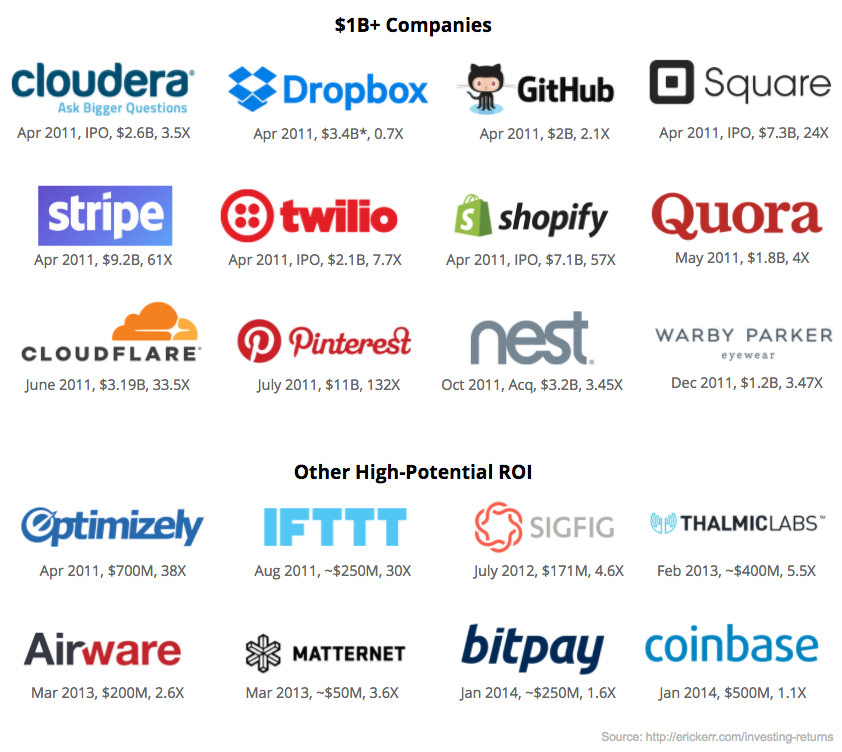

Since its creation in Silicon Valley in 2010, 500 Startups has devoted to around 2,400 firms throughout in excess of 75 regions all over the world. Notable assets from the 500 collection consist of Credit Bukalapak, Canva, Get, Twilio and Karma The RealReal, Ipsy, Udemy, Talkdesk and Knotel.

Beyond supplying seed investment capital, 500 works with startups through its Seed Accelerator Programs which point out expansion advertising and marketing, buyer purchase, slender start-up techniques, and fundraising events for seed organizations.

500 Startups more plays a role in the introduction of creation ecosystems by supporting startups and purchasers thru instructive plans, partnerships and gatherings with governing bodies and corporations worldwide.

About Misk Innovation:

Misk is usually a non-profit basis focused on cultivating learning and leadership in youngsters for those Saudi Arabia of future.

Wefunder: Invest in Startups You Love – Equity Crowdfunding

wefunder.com

Invest as little as $100 in startups and small businesses. Wefunder is the largest Regulation Crowdfunding portal.

With this stop, Misk targets the country’s youth and present diverse means of encouraging skill, imaginative potential, and creativity in a very healthier setting that makes way when it comes to possibilities during the artistry and sciences. Misk (in English “musk”) extracted its brand through the cardiovascular in our Islamic and Arab historical past. That ancient cologne has been utilized for many years as being a mark of benevolence and kindness used by an individual however its perfume engulfs every person.

The Building Blocks is dedicated to informing the youngsters in about three wide professions Education, Media And Culture. These pillars of information will help and support and improve our country’s upcoming. Enabling the Saudi visitors to understand is often a ways to acquire and commute breakthroughs along the enterprise, electronic, literary and ethnic and interpersonal areas of our united states.

Misk pursues these objectives by either developing software programs and partnering with worldwide and local organizations in varied areas. Through a number of incubators, the building blocks is assisting to formulate mental capital and discover the potential of all Saudi men and women.

We know which our company presence can support and greatly enhance a information-established world that principles ongoing understanding, which will provide satisfaction and value to your Saudi world. Our helping guidelines aremotivation and impression, and condition.

500 STARTUPS PROGRAMS, INVESTOR EDUCATION SERVICES, STRATEGIC PARTNERSHIP CONSULTING SERVICES AND EVENTS ARE OPERATED BY 500 STARTUPS INCUBATOR, L.L.C. (Combined With ITS AFFILIATES, “500 STARTUPS”) AND THE FUNDS ADVISED BY 500 STARTUPS MANAGEMENT COMPANY, L.L.C. Will Not Attend ANY REVENUE GENERATED BY THESE ACTIVITIES. SUCH PROGRAMS AND SERVICES ARE PROVIDED FOR EDUCATIONAL AND INFORMATIONAL PURPOSES ONLY AND UNDER NO CIRCUMSTANCES SHOULD ANY CONTENT PROVIDED Together With This Kind Of PROGRAMS, SERVICES OR EVENTS BE CONSTRUED AS INVESTMENT, LEGAL, TAX OR ACCOUNTING ADVICE BY 500 STARTUPS OR ANY OF ITS AFFILIATES.

THIS POST IS INTENDED SOLELY To Offer More Knowledge About 500 STARTUPS. ALL CONTENT PROVIDED In This Posting Is Supplied FOR GENERAL INFORMATIONAL OR EDUCATIONAL PURPOSES ONLY. 500 STARTUPS MAKES NO REPRESENTATIONS Regarding The ACCURACY OR INFORMATION CONTAINED On This Page AND WHILE 500 STARTUPS Has Had REASONABLE STEPS To Ensure The Info CONTAINED HEREIN IS ACCURATE AND UP-TO-DATE, NO LIABILITY May Be ACCEPTED For Almost Any ERROR OR OMISSIONS. FIGURES ARE APPROXIMATED Determined By INTERNAL ESTIMATES AS AT MAY 16, 2020 And Get NOT BEEN INDEPENDENTLY VERIFIED.

UNDER NO CIRCUMSTANCES SHOULD ANY INFORMATION OR CONTENT On This Page Be Regarded As Just As One OFFER To Offer OR SOLICITATION Of Curiosity To Order ANY SECURITIES. FURTHER, NO CONTENT OR INFORMATION CONTAINED In This Posting IS Or Maybe INTENDED As Being An OFFER TO PROVIDE ANY INVESTMENT ADVISORY SERVICE OR FINANCIAL ADVICE BY 500 STARTUPS. UNDER NO CIRCUMSTANCES SHOULD ANYTHING HEREIN BE CONSTRUED AS FUND Ads BY PROSPECTIVE INVESTORS CONSIDERING A Wise Investment INTO ANY 500 STARTUPS INVESTMENT FUND.

ALL LOGOS AND TRADEMARKS OF THIRD PARTIES REFERENCED HEREIN ARE THE TRADEMARKS AND LOGOS In Their RESPECTIVE OWNERS. ANY INCLUSION Of These TRADEMARKS OR LOGOS Will Not IMPLY OR CONSTITUTE ANY APPROVAL, ENDORSEMENT OR SPONSORSHIP OF 500 STARTUPS BY SUCH OWNERS. The Definition Of PARTNER Is Employed IN ACCORDANCE WITH CUSTOMARY BUSINESS PRACTICE AND Is Not Going To INDICATE A LEGAL STATUS Being A “PARTNER” Inside Of A PARTNERSHIP.

500 STARTUPS Has Not Yet TAKEN ANY ACTIONS TO QUALIFY THE DISTRIBUTION OF DEMO DAY UNDER THE SECURITIES LAWS Associated With A JURISDICTION WHERE ACTION For Your PURPOSE Is Necessary. PERSONS OUTSIDE Of The Us WHO VIEW THIS VIRTUAL EVENT MUST OBSERVE ANY APPLICABLE LAWS AND RESTRICTIONS Associated With VIEWING THIS EVENT And Then For Any RELATED ACTIVITIES OUTSIDE Of The Usa.

[1] Source: PitchBook Data Inc., 2019 Annual Global League Tables ( https: //pitchbook. This great site is not responsible for, and does not manage, these types of exterior articles. This content articles are provided with an “as “as and is” available” period and has not been edited in any way. Neither this great site nor our affiliates ensure that the accuracy of or endorse the landscapes or ideas shown in this mass media discharge.

The press generate is provided for informative functions only. The information does not give income tax, legal or purchase assistance or viewpoint with regards to the viability, benefit or success of specific security, stock portfolio or investment decision method. Neither this website nor our affiliate marketers will probably be responsible for any mistakes or errors in the material. Otherwise, for any activities applied by you in reliance thereon. You expressly totally agree that your utilisation of the data inside of this article is to your single threat.

It was an additional strong thirty days for car startups, with one particular autonomous trucking organization in China attracting an immense $100M investment decision. Another sizzling location was optimization of product discovering deployments, like one particular new business launch. Quantum processing, etch devices, and mmWave element during this month’s evaluate 20-two startups that collectively elevated $375M.

It was an additional strong thirty days for car startups, with one particular autonomous trucking organization in China attracting an immense $100M investment decision. Another sizzling location was optimization of product discovering deployments, like one particular new business launch. Quantum processing, etch devices, and mmWave element during this month’s evaluate 20-two startups that collectively elevated $375M. Semiconductors And design

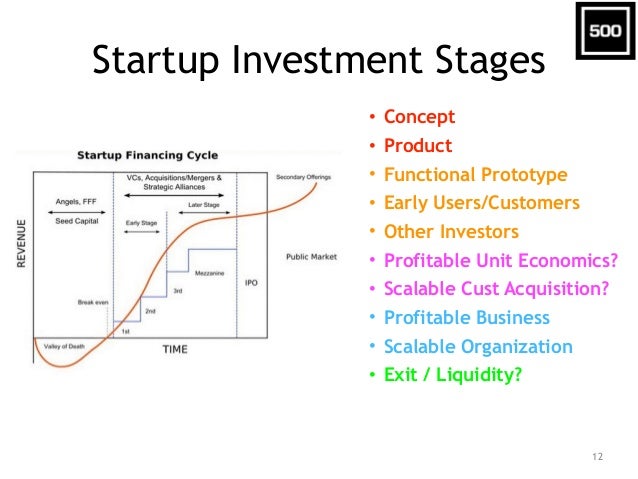

Semiconductors And design Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed.

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed. Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts.

Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts.

You can even took a number of the primary steps in hashing from the toddler small business-might be you have picked the right enterprize model, shut decrease a co-founder, and drafted a target pyramid to outline your first steps.

You can even took a number of the primary steps in hashing from the toddler small business-might be you have picked the right enterprize model, shut decrease a co-founder, and drafted a target pyramid to outline your first steps.

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.