A start-up demands significantly more than just a good idea. It needs loads of dedication, some time and field and even more importantly, funds. In order to set up their surface solidly, a 2016 United kingdom Company Banking institution Questionnaire illustrates the truth that greater than 60% of startups call for additional funding rounds. Hence, without further ado, let’s go over the numerous start-up money phases that each and every online marketer need to know.

Startup Funding Stages You Must Know About

Pre-Seed Funding: The bootstrapping period

Seed Funding: Product creation phase

Series A Funding: First, rounded of VC

Series B Funding: Second, circular of VC

Series C Funding: Thirdly, around of VC

Series D Funding: Special circular of money

IPO: Stock exchange start

The start-up financing rounds have modified this business scenery thoroughly, over the past couple of years. Not lengthy previously, possible startup fundraising events choices had been very few, but lately, we’ve seasoned a surge for startup backing at diverse steps. For a flourishing new venture owner, you must review the place your start-up holders and how a great deal funding is it possible to bring up from outer sources.

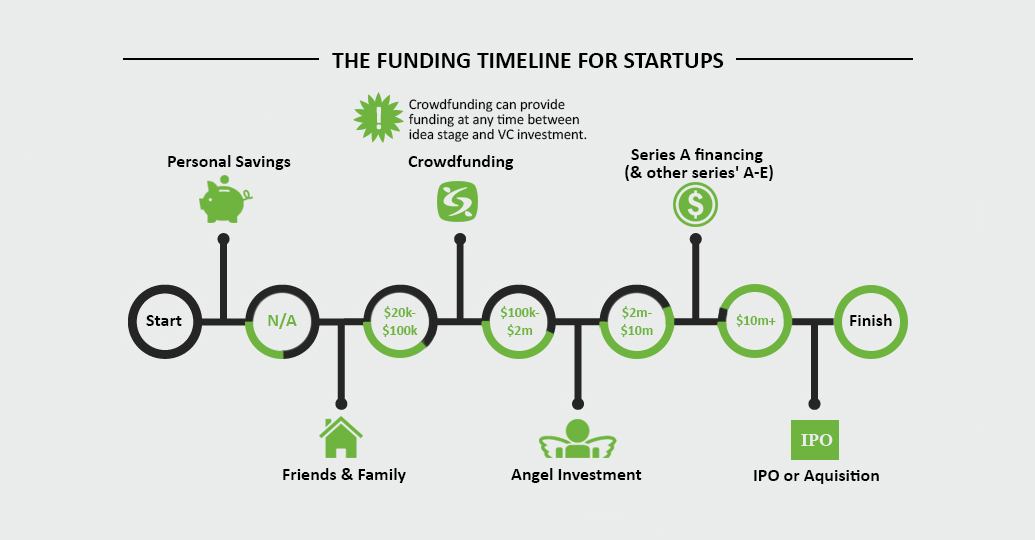

Before we explore particulars of every funds step, here is an overview of significant start-up funds stages.

Now let us delve more intense into different phases of fundraising in a startup lifecycle.

1. The Pre-seed Funding Stage

This prime point of seed funds slips so very early that it is not viewed as a new venture funding. The pre-seed money period normally means interval in which a new venture is getting their business up and running.

It’s most likely that shareholders will not make an asset in return for equity inside the start up throughout the pre-selection level. This stage may last for a long period or you can get pre-collection financing in swift time. It depends around the nature within your new venture as well as preliminary fees you need to take into account even though getting the business enterprise version.

The pre-seed financing point is typically referred to as bootstrapping. In simple words, it means with your individual present tools to be able to degree your start-up. Startup users commit from their possess budget and continue to expand theirselves on the most imaginative fashion.

Throughout the improvement point on the start-up, business people might have to work extra time or acquire a following employment to enable them to commit their more salary in their new start-up.

Let’s discover pre-seed financing from Jonathan Mills Patrick of Funding Simplified:

Adding to what Jonathan reported, the pre-seed funding stage makes it possible for a newbie new venture to build and distribute their solution(s) or program(s) effectively. On the analysis or improvement period, the marketers are likely to study the viability with their idea. They could have a very performing prototype of their own merchandise and therefore are searching for ideal money that allows them to scale their new venture full-time.

In this point, a lot of business people also seek advice from founders who may have been there and also have gone through a comparable working experience as them. It allows them to decide the experiencing costs of their concept or task, create a successful business structure, and garner ideas on how to boost their plan into an running online business.

Entrepreneurs also needs to figure out any essential alliancecopyrights and deals, or any other legalities throughout the pre-selection period as related difficulties are the best solved throughout this period. Down the road, they often turn out to be high priced as well as impossible. Also, no investor will supply resources to your start-up getting legalities before their release.

Potential Investors of Pre-Seed Stage

The most prevalent pre-line purchasers are:

– Startup Owners

– Relatives and buddies

– Early Stage Venture Funds (Micro VCs)

“Ask people who know you actually. Friends, previous co-employees, friends and family, and many more. That could be your better and almost only chance. Failing that ask individuals who are from the market and still have a lot of cash. They could possibly identify one thing for the pre-seed point.” reported Kamal Hassan, Partner at Loyal VC.

Startup Valuation in Pre-Seed Stage

In the pre-seed funds step, startups worth anywhere between $10,000 to $100,000.

Active Pre-Seed Stage Funds

Seedcamp

K9 Ventures

Very first, circular

2. Seed Funding Stage

After the pre-seeding phase, it is time for you to essentially grow the seed. The earliest within the new venture financing phases is “Seed funding”. Almost 29 pct of startups fail because they exhaust your money whilst bootstrapping, which makes seed budget vital to get yourself a enterprise installed and operating.

Entrepreneur changed individual, Mark Suster says: “The one main slip-up founders make is ready until eventually they may have insufficient cash in the financial institution just before fund raising”

You can think about the seed funds point as being an example of placing a tree. Ideally, the first backing would be the “seed” which allows any new venture to blossom. After you supply ideal standard water i.e. a prosperous online business strategy, along with the perseverance in the business person, the new venture will in the end grow into a “tree”.

FundersClub

fundersclub.com › learn › guides › startup-equity-investments

Since the investors are taking a big threat by using this business, startups need to give them fairness towards seed fundings. The stakes are even higher due to the fact, during this period, startups are unable to promise a very good enterprize model.

Seed money enables a start-up to fund prices of item introduction, get ahead of time grip thru marketing and advertising, commence important selecting and further consumer research for building merchandise-industry-in shape.

Many startups check out the seed backing rounded will be all that is definitely required to with success receive their start up up and running.

Potential Investors of Seed Stage

The normal varieties of investors who participate in seed backing are:

– Relatives and buddies

– Angel Investors

– Early Stage Venture Funds (Micro VCs)

– Crowdfunding

Startup Valuation And Fundraising in Seed Stage

Startups which might be qualified to receive seed funds possess a company that beliefs anywhere between $3 mil to $6 mil. The seed funds period will facilitate funds from $50,000 approximately $3 zillion for a guaranteeing start up.

Active Seed Stage Funds

500 Startups

Y Combinator

AngelPad

Techstars

Speedinvest

Learn All About Funding from Experts by Joining the most effective Communities.

Enter email message to download and install a list of 100+ Communities.

Thank You

Your List is on it is Strategy to Your Inbox.

3. Series A Funding Stage

Series A period will be the primary round of enterprise funds credit.

Nowadays, the start-up essential a created system and also a subscriber base with steady income circulate. Now it is time so that they can select collection A funding and optimise their importance solutions. It is really an best option that enables startups to size them selves spanning different markets.

From the Series A financing round, it’s major to possess a prepare that may create long-term revenue. Frequently, startups come up with wonderful strategies that will crank out a large amount of eager people, on the other hand, they have no idea the best way to monetize it in the long run.

Right here is the period the place you must start learning how fundraiser is effective and commence helping to make very early contacts with angel traders and VCs. Following a 30-10-2 rule, you need to establish brokers who would want to buy your start up. You should uncover 30 purchasers who are able to buy your online business, based on this rule of thumb. 10 outside of people 30 brokers may well reveal desire for your proposition, 2 in which will truly complete on money for you.

Mark Suster mentioned, “Meet your possible buyers beginning. Inform them you’re not rearing funds however but that you will be within the next a few months or possibly even longer. Tell them you actually like them so you would like them to find an early perspective (which can be what all shareholders want).”

Series A financing primarily is produced by angel traders and typical enterprise money businesses. They are not in search of “great ideas”, as a substitute, they are searhing for startups having a reliable business plan that may flip their good idea into a successful, hard earned cash-doing business, letting the shareholders to reap the benefits of their expenditure.

One entrepreneur could function as an “anchor” but once a start-up has properly secured its first investor, it is much easier to draw in additional purchasers. Although angel brokers prefer to devote during this level, they are apt to have far less effect than VC businesses with this phase.

Potential Investors for Series A

– Accelerators

– Super Angel Investors

– Venture Capitalists

Company Valuation And Fundraising in Series A

Startups with a decent strategic business plan valuing nearly $10 million to $30 million are capable of increase around $15 million in the Series A funding level.

Active Series A Investors

IDG Capital

New Enterprise Associates

Plug and Play

SOSV

4. Series B Funding Stage

Startups that go through the former start-up backing steps (seed Range and financing A) already have designed a considerable consumer starting point beside a steady stream of revenue. They have demonstrated by themselves when in front of their brokers that they are can be successful at the much larger scale.

Investors support startups to grow their horizons by funding their industry access routines, improving their current market share, shape working groups for example promotion, online business development, and shopper achievement. The sequence B backing point allows startups to develop so that they can satisfy the various requires of their own clients and also contend in tight markets concerning opposition.

Series B money period could appear to be just like former backing level concerning processes and essential participants, even so, series B funding is normally brought by exact same characters, including a crucial anchor individual that really helps to catch the attention of other brokers. The major difference is the addition of a brand new wave of VCs focusing on committing to perfectly-set up startups to be able to even more go over requirements.

“The dilemma is the fact that although your Series A investors were essential for your needs during that spherical, they might not be the investors you will want going forward. When you are within a location where by planning general population is actually a possibility, you will want the crossover purchasers which will be there for you today and whenever you go open public,” implies Praveen Tipirneni, MD & CEO of Morphic Therapeutic Inc.

Potential Investors for Series B

– Venture Capitalists

– Late step VCs

Company Valuation And Fundraising in Series B

Startups with a earnings-generating product, valuing close to $30 mil to $60 thousand are able to increase about $30 thousand while in the Series B financing stage.

Active Series B Investors

Khosla Ventures

GV

StartX (Stanford-StartX Fund)

5. Series C Funding Stage

Startups which make it to your range C funding step ought to be on his or her progress way. These startups try to find even more backing which could help them make new services, achieve new sells, even attain other underneath-executing startups from the similar marketplace.

On the line C funds step, buyers happily fund prosperous startups. They are really hopeful to obtain a profit that is greater than the bucks they devote. The Series C funding point is focused on scaling the startup as quickly as is possible.

To level your start up substantially, you could purchase diverse startups using the Series C funding. By now, your start up operations have become a lesser amount of hazardous as opposed to even more purchasers are coming in to spend time playing. Many hedge resources, expense banking institutions, exclusive home equity providers and many more. will gladly purchase your startup while in the Series C step.

The start-up has demonstrated themselves to always be an managing success. That is certainly

The primary reason for this. New investors become a member of the game by committing lots of cash into growing startups to acquire their own individual placement as top rated brokers.

Do remember that startups that engage in Series C Funding are very-identified, carry a very good subscriber base, have procured secure cash flow streams beside tested records with their growth, and want to grow their procedures with a world-wide size. You’re not available for those Range C funds but.

“Now is actually a more effective time than before for appearing businesses to obtain the funds they must improve their expansion,” claimed Marz Ayyad, EMEA Lead at NetSuite PE & VC Practice.

Potential Investors for Series C

Company Valuation And Fundraising in Series C

Startups with an above average enterprise development valuing approximately $100 million to $120 million can easily bring up close to $50 mil over the Series C funding point.

6. Series D Funding Stage and Beyond

Hardly any startups look for a will need to go to this particular phase. The Series D backing phase permits enterprisers to increase funds for the special problem. In the event it has not yet nevertheless attack its improvement purpose.

Whether or not this hasn’t ended up public nevertheless, but is contemplating a merging with a competitor on reasonable phrases,

A start-up may possibly take into consideration selection D financing. The Series D money features startups the best possible options permitting them to discuss problems go-on by getting a different startup being a merging.

Also, When a start up was can not attain its progress landmark with series C finances, this will find a have to get a lot more money through series D money to help keep afloat.

Potential Investors for Series D

– Late period VCs

– Private Equity Firms

– Hedge Funds

– Banks

Company Valuation & Fundraising in Series D

Startups in this particular stage may possibly appeal around $150 mil to $300 mil can elevate roughly $100 mil during this new venture money stage.

Active Series C & D Investors

Accel

Sequoia Capital

Founders Fund

– Lightspeed Venture Partners

7. Initial Public Offering (IPO)

IPO is the procedure of offering business gives to the public the first time.

Growing startups that require funds usually utilize this approach to get resources, whereas set up companies put it to use enabling start up proprietors to get out of some or their acquisition by offering the reveals to most people.

If a new venture decides to travel general population, a given range of activities happen throughout the IPO course of action. They include things like:

– Formation of any outer public presenting organization comprising oflawyers and underwriters, accredited open public an accountant, and SEC industry experts.

– Compilation of your startup’s Information like its monetary performance as well as its predicted near future business.

– Audit on the startup’s economical claims occurs which generates an thoughts and opinions about its public providing.

– The start-up data files its prospectus with all the SEC and establishes a particular time for planning community.

Primary advantages of IPO

Raising money for that startup is simply not the sole benefit that marketers delight in if there is a consumer presenting. A few other positive aspects are:

– A community organization can crank out more finances by way of supplementary products as it currently has access to public marketplaces.

– Many public companies recompense management by means of stock. The stocks and shares of an general population company will be more appealing to personnel when the shares may be available effortlessly. Also, becoming consumer enables an organization to sign up more effective natural talent too.

– Mergers are easier for a open public enterprise as it can certainly use its general public gives to obtain one other start-up.

Basically

The different start up backing stages let internet marketers to scope their startup at any phase in their entrepreneurial experience. As a way to assist them increase.

Do remember that to be able to achieve funds, startups should be mature plenty of to receive a particular backing round. You may discover the place your new venture holders by its net worth.

Many start-up owners retire when right after they have eliminated general population. Many amidst them also favor turning out to be an angel buyer by themselves and shell out their money into other startups. After all, they have unquestionably attained the right to chill out and advise other marketers regarding how to grow their start up to make it lucrative.

Sameer Dholakia, SendGrid CEO has claimed, “I believe the most significant gain is our increased company profile, which can be useful when you are appealing to both equally clients and teammates.”

Frequently Asked Questions

– Q. How to look for the add up to raise in each spherical?

CEO of Y Combinator, to be able to decide the money required for your start-up, you must implement this easy method.

Multiply the number of folks you want to use, days $15,000 days 18 (a few months).

If you wish to retain the services of 5 employees, you are able to put on the aforementioned formulation as, for instance:

5 by $15000 by 18 = $1,350,000 is definitely the funds you will need for the next eighteen months from your start-up.

For your abrasive approximation, the the bare minimum backing you will get in each and every circular will be as uses:

– Q. How much equity to pay with an entrepreneur inside the seed stage?

According to Prasanna Krishnamoorthy, a growth and product or service trainer, assuming that you may have great grip by having an spectacular expansion of your new venture, to raise a $1 mil seed funding:

A opportunity capitalist would like to get 10%-20Per cent within your startup’s home equity.

An angel buyer would want to get 15-25a Per cent of the startup’s collateral.

– Q. The way to get seed money?

If you are intending to or have recently launched your new venture, the possibility buyers for your own new venture idea will be none other than oneself along with the about three classical Fs – Fools, Friends & Family.

Angel buyers or project capital businesses refrain from making an investment throughout the ideation phase since they are not aware of your amount of devotion and ways in which very well your plan can evolve to a successful business.

– Q. What the heck is sequence A money to obtain a start up?

Series A financing typically starts if a start up is money-making and contains a minimum of gotten to the burst-even phase. Series A signifies the state financing by businesses. And, when enterprises devote, it can be in millions. Now, if a startup believes it vital it might opt for one other funds around. But that can suggest much more diluted conveys of your corporation.

Whenever we determine that scope, then this start-up financing steps will probably be like…

Pre-Seeding Round: $ to $50,000

Seeding Round: $50,000 to $3 thousand

Series A Funding: $3 mil to $6 thousand

Series B Funding: $ten million to $30 mil

Series C Funding: $30 thousand to $50 thousand

Series D Funding: $50 zillion and earlier mentioned

The start up provider can either select even more financing rounds to mention an IPO.

If a new venture has more technical revenue targets this could go on to get selection E, so, G and F on.

Related Article:

The way to get Startup Funding For Kick-starting up Your Business

Startup Pitch Deck 101: How To Create a Winning Pitch Deck For Startup

Share This Informative Article

Start Creating Web Apps on Managed Cloud Servers Now

Easy Web App Deployment for E, Startups, Businesses and Developers-Commerce Industry.

Arsalan Sajid

Arsalan, a Digital Marketer by job, is effective as being a Startups and Digital Agencies Community Manager at Cloudways. He likes things entrepreneurial and awakens daily together with the desire to encourage the dreams of aspiring marketers thru his do the job!

This past year was the best productive calendar year of fundraiser by African technician startups>

This past year was the best productive calendar year of fundraiser by African technician startups> Greycroft Partners is really a US-primarily based project budget corporation which largely invests in online technology and media startups. They goal beginning-level firms with fresh founders, commonly in “seed” or “Series A” rounds based on Fortune. Depending on the very same record, they likewise have a keen need for startups that will be going by female business people and creators. They fairly recently purchased a Kenyan bitcoin transaction BitPesa, Nigerian and solution payment answer, Flutterwave. They already have two funds readily available: Greycroft IV, a $204 thousand venture account and Greycroft Growth II, a $365 zillion development-step account. Greycroft Growth II starts off at $ten million and may spend close to $35 million within a firm.

Greycroft Partners is really a US-primarily based project budget corporation which largely invests in online technology and media startups. They goal beginning-level firms with fresh founders, commonly in “seed” or “Series A” rounds based on Fortune. Depending on the very same record, they likewise have a keen need for startups that will be going by female business people and creators. They fairly recently purchased a Kenyan bitcoin transaction BitPesa, Nigerian and solution payment answer, Flutterwave. They already have two funds readily available: Greycroft IV, a $204 thousand venture account and Greycroft Growth II, a $365 zillion development-step account. Greycroft Growth II starts off at $ten million and may spend close to $35 million within a firm.

In May 2016, a regulations needed result which allows a person to commit at the least a selection of their money in startup investment (

In May 2016, a regulations needed result which allows a person to commit at the least a selection of their money in startup investment (

Long ago, I published a post about personal home equity or. opportunity funds – and quite a few other web sites but not only copied the ideas, and also had immediate estimates while not attribution from your report.

Long ago, I published a post about personal home equity or. opportunity funds – and quite a few other web sites but not only copied the ideas, and also had immediate estimates while not attribution from your report. Facebook’s mission to join the earth has long been part of the company’s information at MWC in Barcelona for quite some time now. But even though the show was canceled this coming year because of problems over the coronavirus outbreak, the corporation is hitting ahead with its latest connection up-dates. On Tuesday, Facebook designed several announcements about its several jobs built to provide affordable internet access to folks in developing countries around the world and outlying areas.

Facebook’s mission to join the earth has long been part of the company’s information at MWC in Barcelona for quite some time now. But even though the show was canceled this coming year because of problems over the coronavirus outbreak, the corporation is hitting ahead with its latest connection up-dates. On Tuesday, Facebook designed several announcements about its several jobs built to provide affordable internet access to folks in developing countries around the world and outlying areas.

Do you share content on LinkedIn? Wondering how to publish LinkedIn content that gets more clicks and engagement?

Do you share content on LinkedIn? Wondering how to publish LinkedIn content that gets more clicks and engagement? Content That Works on LinkedIn

Content That Works on LinkedIn