A hypothetical new venture can get about $15,000 from family and friends, about $200,000 from an angel opportunist three months later on, and about $2 Million from your VC another several months down the road. If all moves effectively. Discover how funds works with this infographic:

First, let’s decide why we have been discussing funds as a thing you must do. This is not a given. The exact opposite of money is “bootstrapping,” the procedure of financing a start up via your possess discounts. There are a few firms that bootstrapped for a long time until acquiring investment decision, like MailChimp and AirBnB.

If you know the basic principles of methods financing functions, skim on the finish. On this page I am just supplying the most convenient to grasp clarification with the operation. Let’s start with the fundamentals.

Everytime you will enjoy money, you allow up some your organization. The more funds you have, the better firm you allow up. That ‘piece of company’ is ‘equity.’ Everyone you allow it to is a co-operator within your firm.

Splitting the Pie

The standard notion regarding fairness may be the splitting of an pie. Once you start something, your cake is really compact. You will have a completely of an seriously compact, chew-measurements pie. Whenever you take outdoors investment decision plus your corporation develops, your pie gets more substantial. Your piece from the bigger cake is going to be larger than your very first nibble-measurements pie.

When Google decided to go general population, Larry and Sergey experienced about 15% on the cake, each and every. But that 15Per cent was actually a smaller cut of your seriously large pie.

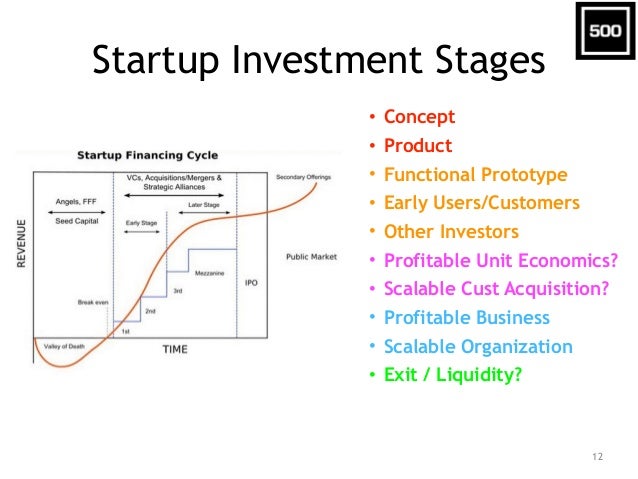

Funding Stages

Let’s evaluate the way a hypothetical start up would get funds.

Idea step

At first it is just you. You happen to be pretty brilliant, and right out of the lots of concepts one has experienced, you ultimately choose that right here is the 1. You start taking care of it. As soon as you started performing, you started developing benefit. Because you own personal 100% of it now, and you are the only particular person inside your still unregistered business, you happen to be not really considering value however.

Co-Founder Stage

As you begin to convert your plan to a real prototype you realize it happens to be consuming you for a longer period (it more often than not does.) You are aware of you could potentially actually use a different person’s skills. And that means you search for a co-creator. You find somebody that is both sensible and excited. You communicate for two days and nights on your idea, and you observe that she is putting a great deal of price. Therefore you offer them to become co-creator. However you can not pay out her anything (just in case you could, she would turn out to be a worker, not really a co-creator), and that means you offer equity to acquire job (sweat home equity.) But exactly how a great deal in the event you give? 20Per cent – too little? 40%? All things considered it is actually YOUR concept that even designed this new venture occur. But you realize that your start up is really worth almost almost nothing at this stage, with your co-founder takes a huge threat upon it. You will also know that given that she is going to do half the project, she ought to get the same as you – 50Percent. Otherwise, she could possibly be a smaller amount inspired than you. A real partnership is dependant on value. Respect is dependant on fairness. Anything lower than fairness will collapse eventually. And you want this thing to last. And that means you give your co-founder 50Percent.

Soon you realize that the two of you have been consuming Ramen noodles 3 times daily. You will want money. To date you do not believe you possess enough of a doing work product to show, and that means you search at other available choices.

The Friends and Family Round: You consider adding an advert inside the newspaper announcing, “Startup investment prospect.” But your legal representative good friend shows you that might violate securities laws and regulations. Now you happen to be “private company,” and asking for funds from “the general public,” that is definitely individuals you do not know will probably be “public solicitation,” that is unlawful for individual businesses. So, who will you have hard earned cash from?

1. Accredited investors – Individuals who frequently have $1 Million from the bank or make $200,000 every year. They are the “sophisticated investors” – that could be individuals that the federal government believes are wise adequate to determine no matter if to buy an especially-dangerous firm, like the one you have. What if you don’t know a person with $1 Million? That you are lucky, since there is an exemption – friends and relations.

2. Best freinds and family – Whether or not your best freinds and family are certainly not as wealthy as a possible investor, you can actually nevertheless take their funds. That is what you want to do, since your co-creator has a vibrant uncle. You allow him 5Per cent of your corporation to acquire $15,000 income. You can now pay for space and ramen for one more 6 months whilst establishing your prototype.

Registering the corporation

To present uncle the 5%, you authorized the firm, sometimes however an on-line provider like LegalZoom ($400) [1], or through a legal professional good friend ($-$2,000). You supplied some popular store, brought 5% to uncle and set apart 20Per cent for your potential employees – which is the ‘option swimming pool.’ (You probably did this for the reason that 1. Future shareholders will need a possibility swimming pool area 2. That share is protected from your and you also co-founders undertaking anything from it.)

The Angel Round

With uncle’s money in wallet and six months before it finishes, you understand that you need to search for your upcoming money reference right this moment. If you run out of funds, your start-up passes away. So, startup investment you check out the possibilities:

1. Incubators, accelerators, and “excubators” – these spots normally supply cash, doing work room, and analysts. Your money is snug – about $25,000 (for five to tenPer cent of the corporation.) Some analysts can be better than dollars, like Paul Graham [2] at Y Combinator.

2. Angels – in 2013 (Q1) the regular angel rounded was $600,000 (coming from the HALO report). That’s the good news. Angels were definitely supplying those funds to companies that they priced at $2.5 mil. Which is the not so good news. So, now you must to inquire about when you are well worth $2.5 million. How do you know? Create your very best event. Let’s say it can be however early days to suit your needs, along with your doing work prototype is not that considerably alongside. You see an angel who looks at everything you have and perceives that it is value $1 mil. He agrees to pay $200,000.

Now let us count number what portion of the firm you might give the angel. Not 20Per cent. We have to add more the ‘pre-cash valuation’ (how much the firm will probably be worth before new cash can be purchased in) plus the financial investment

$one thousand,000 + $200,000 = $1,200,000 publish-dollars valuation

(Consider it in this way, first you consider the income, Startup investment then you definitely provide the offers. In the event you brought the reveals before you decide to extra the angel’s financial investment, you would be splitting up that which was there until the angel joined. )

Now divide your time and money because of the post-money valuation $200,000/$1,200,000=1/6= 16.7%

The angel will get 16.7Per cent from the corporation, or 1/6.

How Funding Works – Cutting the Pie

Have you thought about you, your co-creator and granddad? How much are there remaining? Your stakes are going to be watered down by 1/6. (Begin to see the infographic.)

Is dilution terrible? No, as your pie has become much larger with each investment. Certainly, dilution is negative, simply because you are giving up control of your small business but. So, what should you do? Take expense only when it is important. Just take money from people you value. Which is additional in the future.)

Venture Capital Round

Finally, you have built the initial type and you will have traction with users. You tactic VCs. Exactly how much can VCs provide you? They devote to the north of $500,000. Let’s repeat the VC valuations what you have now at $4 zillion. Again, that is certainly your pre-cash valuation. He states he wants to spend $2 Million. The math concepts is equivalent to in the angel circular. The VC obtains 33.3% of your respective company. Now it’s his corporation, way too, even though.

Your first VC around can be your range A. You can now go on to obtain selection B,C – at some time sometimes with the a couple of issues will happen for you personally. Either you might run out of backing without an individual may wish to spend, so you pass on. Or, you obtain sufficient funds to develop one thing a greater business hopes to obtain, and so they obtain you. Or, you should do very well that, just after many rounds of funds, you want to go general population.

Why Companies Go Public?

The two main fundamental causes. This period from countless ordinary folks, despite the fact that formally an IPO is merely another way to bring up money. Via an IPO a business can sell off stocks for the inventory market and any one can acquire them. Since everyone can get you can probable market plenty of supply right away as an alternative to head to personal shareholders and ask them to make investments. So, it appears such as an much easier way to get funds.

You can find one other reason to IPO. All those those who committed to your corporation so far, such as you, startup investment are retaining the so-known as ‘restricted stock’ – essentially this is supply that you can’t basically go and then sell for money. Why? Because this is supply associated with a company that has not been so-to-say “verified via the authorities,” and that is exactly what the IPO procedure does. Unless the federal government notices your IPO documentation, you can at the same time be selling snake engine oil, for all individuals know. So, the us government perceives it is not protected to let typical men and women to buy these types of businesses. (Obviously, that immediately precludes the inadequate from making substantial-profit investment strategies. But that is definitely one other narrative.) Those who have sunk thus far need to last but not least translate or sell their limited stock and obtain income or unrestricted share, which happens to be just about as nice as cash. This is usually a liquidity affair – when exactly what you have ends up being easily convertible car into dollars.

There is another group that basically want you to IPO. A purchase bankers, like Goldman Sachs and Morgan Stanley, to name the favourite ones. They will give you a request and get in touch with to always be your cause underwriter – your budget that readies your IPO documentation and calls up well-off clients to offer them your share. How come the bankers so anxious? Because they get 7Percent out of all the dollars you elevate within the IPO. In this infographic your start-up heightened $235,000,000 during the IPO – 7% of these is all about $16.5 thousand (for two to three days of work to get a organization of 12 bankers). It is actually a earn-win for everyone.

Being an Early Employee with a Startup

Last of all, some of your “sweat equity” investors were early personnel who had carry in exchange for doing the job at lower wages and coping with the chance that a start-up could fold. At the IPO it can be their dollars-out day.

Notes

1. ^ LegalZoom LLC and incorporation price deals (retrieved from legalzoom.com on jul 3, 2019).

Investing

Investing

It was an additional strong thirty days for car startups, with one particular autonomous trucking organization in China attracting an immense $100M investment decision. Another sizzling location was optimization of product discovering deployments, like one particular new business launch. Quantum processing, etch devices, and mmWave element during this month’s evaluate 20-two startups that collectively elevated $375M.

It was an additional strong thirty days for car startups, with one particular autonomous trucking organization in China attracting an immense $100M investment decision. Another sizzling location was optimization of product discovering deployments, like one particular new business launch. Quantum processing, etch devices, and mmWave element during this month’s evaluate 20-two startups that collectively elevated $375M. Semiconductors And design

Semiconductors And design