Where could you get backing for your new venture?

Seeing that we know of how a lot backing we require, we must find the proper provider.

Partly A pair of our Masterclass, we have recognized and explained 9 Startup Funding Sources:

1. Personal savings

2. This company per se

3. Friends and relations

4. Government subsidies and gives

5. Incubators and accelerators

6. Bank financial products

7. Convertible information

8. Venture equity

9. Venture debts

If you are looking for any information from the alternative ideas, we now have you taken care of in this article.Creating the best decision for the online business commences by knowing the options>

A. Funding solutions rapid guidebook

Use these inquiries to discover a potentially good funds source suit for your personal start-up.

Carry out the terms early on stage, notion period, or pre-income pop into your head when conversing about your startup?

– Are you thinking about to spend your own financial savings or discussing with relatives and buddies?

– And/Or looking for a tiny exterior investment decision and access in an ecosystem and suggestions by getting started with an accelerator or incubator?

– And/Or would you like to have an experienced buyer as being a shareholder?

– Perhaps, while accomplishing this, you want to think about among the frequent instruments employed in seed investment, the convertible car link?

Are you presently creating a new engineering or thinking about starting a completely new imaginative endeavor?

– Have you considered trying to get a governing administration offer for a low-priced cause of resources to back up your plans?

Did you hustle your path out of your pre-profits step and trying to find money to size your enterprise?

– Have you thought about preserving all the collateral and bootstrapping your path to the top level?

– Or are you prepared for taking an outside investor in your shareholder composition?

Has been income beneficial around the corner, do you want any investments in apparatus, or do you need tips on how to fund your doing work investment capital?

– Have you ever already talked to any area finance institutions? Were you aware that you will find governing administration software programs supporting finance institutions to provide to startups?

Or do you just raise a opportunity circular and looking for extra cash unless you go deep into the next fundraising events?

– Why do not you think of what a lot of, Airbnb and Uber others did before you start to, and carry out business debt being the connect between money rounds?

Continue reading about all the info partly A couple of our Masterclass about money options.

B. When you should increase VC dollars

As you go over the higher than concerns, it would be that you wind up hunting for a VC expense.

They are also generally confusing.VCs are a significant part of the startup ecosystem, as they give you a large a part of the invested capital>

So as to fully grasp should this be the proper path on your start-up, educate yourself on Venture Capital in Part Three of the Masterclass “When to boost VC Money (and when to not ever)”.

To conclude, it is essential to comprehend about VCs is how they are incentivized when making a choice.

VCs handle outdoors investment capital and be dependent significantly with their capability to supplier new capital. The main element owners in locating budget are definitely the in general account efficiency and the ability to source high-amount specials.

To have excellent returns like a VC, you will be highly influenced by a couple of major residence operates,

Now research indicates that. Also known as the strength Law in VC committing, this correctly means that the functionality with the fund is determined by only a few investment opportunities with impressive results.

Just what does this indicate for you being a start up in search of backing? It implies that you now have a thought precisely what a VC individual looks that along with you can see should you be a suit.

Below are some issues to help you to gauge how your start up would easily fit in a VC investment portfolio.

Does your start-up categorize as being a “potential significant win”?

– Do you have a $10bn essentially addressable industry?

– Could your small business attain +$100m in yearly earnings in a 7-8 calendar year time frame?

– Of course, if so, what can it take to arrive there (geographies, verticals, marketplaces)?

Is the enterprise insanely scalable?

– Does placing new customers rarely improve the sophistication of your own business?

– Do you have a rather lower supplemental expense to supply to additional clientele?

– Do you have a supplement that is really “plug and play” spanning sells?

– Have you got a item that is ready, and is dollars the leading blocker from obtaining industry promote?

Does your enterprise involve degree to succeed?

– Will you be operating a current market, a mini-convenience carrier, startup investors or any other company that positive aspects substantially coming from the extra size?

– Are your unit economics exceptionally reliant on getting the perfect scope?

– Or do you require a giant financial investment at the start with the commitment of good scalability later on?

Can you brain handing out handle?

– Will you are convinced that having ten percent of your online business with VC money defeats possessing 80Per cent on the enterprise without?

– Do you really not imagination working with and reporting to skilled traders?

Do you want to sell or go community over the following 5-10 years?

– Are you ready to start the time and prepare your business on an exit inside the VC timeframe?

– Do you brain managing a consumer organization with the open public examination it requires?

– Or are you presently ready to target one other field person or a money recruit in due course?

– Can you thoughts possessing constrained influence during the exit final decision?

If your new venture is not going to physically fit these criteria, don’t get worried. There are additional ways to produce a excellent enterprise. Did you ever hear about bootstrapping? Browse the last portion of Aspect Three in our Masterclass.

C. How to divide start up collateral

It is important to get the household if you would like.Before you can leave the house there and raise money for your personal startup>

One of the important pieces is to make a decision on the way you can divide your collateral amongst the workers, experts and creators.

For your detailed look at to be able to break up the value the proper way check out Part Four in our Masterclass “How to Split Startup Equity the best Way”.

Beyond choosing exactly how much to allocate to which, it is additionally pretty essential that you get it done properly, guarding your and oneself small business for when it can do not figure out as expected.

This is also very important to your opportunist, who can become a co-seller within your online business. Not securing your organization therefore does mean not securing your entrepreneur.

Below are some tips to utilize before you head into a venture capitalist conference.

Think prior to deciding to spend

Are you certain which the advisor/staff member/co-founder can deliver about the assures?

– Perhaps you have spoken to past employers/people/lovers?

– Did you see any prior assignments?

– Did you have plenty of time to really analyse the cabability to present?

Do you have a very similar perspective on near future cohesiveness?

– Can you reveal equivalent targets and priorities?

– What will take place in the channel time period, do you notice a position both for?

Work with turn back vesting

Founders typically be given their fairness initially, but what will happen in the event it does not figure out and each of your co-creators foliage?

You happen to be even now at the beginning of the street and you have this founder with some control of your small business.

This is when invert vesting will come in, simply by making the collateral gift item conditional around the creator staying in position. Portion of the collateral is given back to the company.

Setup fantastic corporate governance

Should you and a co-founder disagree,

What occurs?

Who is available in as being the tie burst? Or do you really just have a lot more voting rights? They are inquiries to give some thought to.

One of the ways to handle these complaints is having a fantastic board of directors which will be component of the most basic actions.

Keep control over who owns the gives

It could possibly slip inside the bad palms.One of many important hazards of giving away plenty of equity>

You are able to protect by yourself by making use of often the right of First Refusal or a Blanket Transfer Restriction which lets you find the shares initial or restrictions the promoting totally.

Put together the best home equity motivator program for workers

Startups are really a high-risk online business and so they draw in a unique type of staff member. One of several essential methods to pay back this staff member is via equity incentive programs.

Investors will have you book ample home equity (probably away from your possession) to incentive and appeal to the desired natural talent to construct your online business.

Read up on the dissimilarities among solutions and gives and look at the regional patterns.

When starting an value motivation program take the following advice:

Understand your employee’s demands: Not all markets neither personnel share the same desire for foods for equity. Be aware of the adjust and needs.

Employees discuss: Always remember that personnel around industrial sectors and firms talk about their settlement. Try to be in the vicinity of market expectations.

Be clear: Equity is not always as common as it seems. Be sure that you are clear to employees therefore they know the actual value and negative aspects exactly where needed.

D. Learning the various startup funding rounds

Another fundamental element of getting expenditure in your start up is knowing as to what backing stage you presently are. Because 1 will not simply petrol up when.

Also various necessities in terms of progress.With each stage appear unique complications and needs>

Educate yourself on all of the different levels in Part Five of our own Masterclass “Startup Funding Rounds: The Ultimate Guide from Pre-Seed to IPO”.

As a way to know of your location, you are able to contemplate the next problems:

– Would you just build a business plan or specialized notion and are searching for money to make an MVP?

-> Pre-seed / Seed

– Do you just roll-out your MVP and are also you experiencing the primary shoppers appear? Will you be now trying to find backing for your personal 1st important hires to actually create your primary merchandise and demonstrate your products market suit?

-> Seed

– Did you just decide your products or services marketplace fit, develop a scalable and repeatable product, and set the basis to build range inside your gross sales? Then it is time for you to excellent-energy your expansion.

-> Series A

– Are you presently in the midst of insane expansion and can’t take care of the generated requirement?

-> Series B

– Have you been having a start-up valued at $100m or over with few years of robust advancement behind you? But you are not all set open public and want much more enough time to finetune your business?

-> Series C if not more

– Are your and you simply traders in a position to sell off some offers? Does the firm provide the confirming and operations design into position to undergo existence as a public business?

-> IPO

E. Lastly: choosing the ultimate buyers

Since you now have a very good concept of simply how much financing you want for your own start-up, know what resources you intend to use, and know what spherical you are searching for, it truly is a chance to discuss how to locate these challenging brokers. And how to find the proper versions.

For any detailed and helpful report on the best way to pick in order to find the best shareholders, have a look at Part Six in our Masterclass “How to discover the Right Investors”.

Firstly, there are 2 distinct periods when it comes to bringing up cash. A networking manner along with a fundraising events method.

Why this distinction?

Well assuming you have possibly involved in fundraising it will be easy to attest to this: it dominates anything. From the minute you awake to your minute you go to sleep, it will always be surface of mind. It truly is hopelessly annoying and that is certainly why you must restrict it into the least amount of amount of time possible. Be in, ensure you get your money, go outside.

That does not mean nevertheless you should prevent talking to new conference and other people buyers in an exceedingly informal location. Hence, the network function. Nevertheless the second you get in to a bedroom to pitch your start-up, you will be in fundraising setting. Be mindful, traders love to pull you into fundraising mode, as it offers these people with the opportunity to commit to you right before others.

Once you have made the decision that it must be fundraising events option you must do your research and become set up.

To us, the two main crucial methods.

First, generate a collection

Get started by getting an inventory in the right after assets:

Network: Ask fellow people and marketers inside the landscape (they might possess a checklist).

Accelerators and Incubators: In case you are component of 1, don’t forget to leveraging your participation. If not, asking never ever is painful.

Government departments: In several places, the us government has create providers precisely that will help out setting up business owners. They normally have this sort of information and facts.

Universities: Contact alumni networking systems, entrepreneurship assist communities and college personnel for qualified prospects.

Directories: Big internet directories like CrunchBase and AngelList may be a wonderful reference.

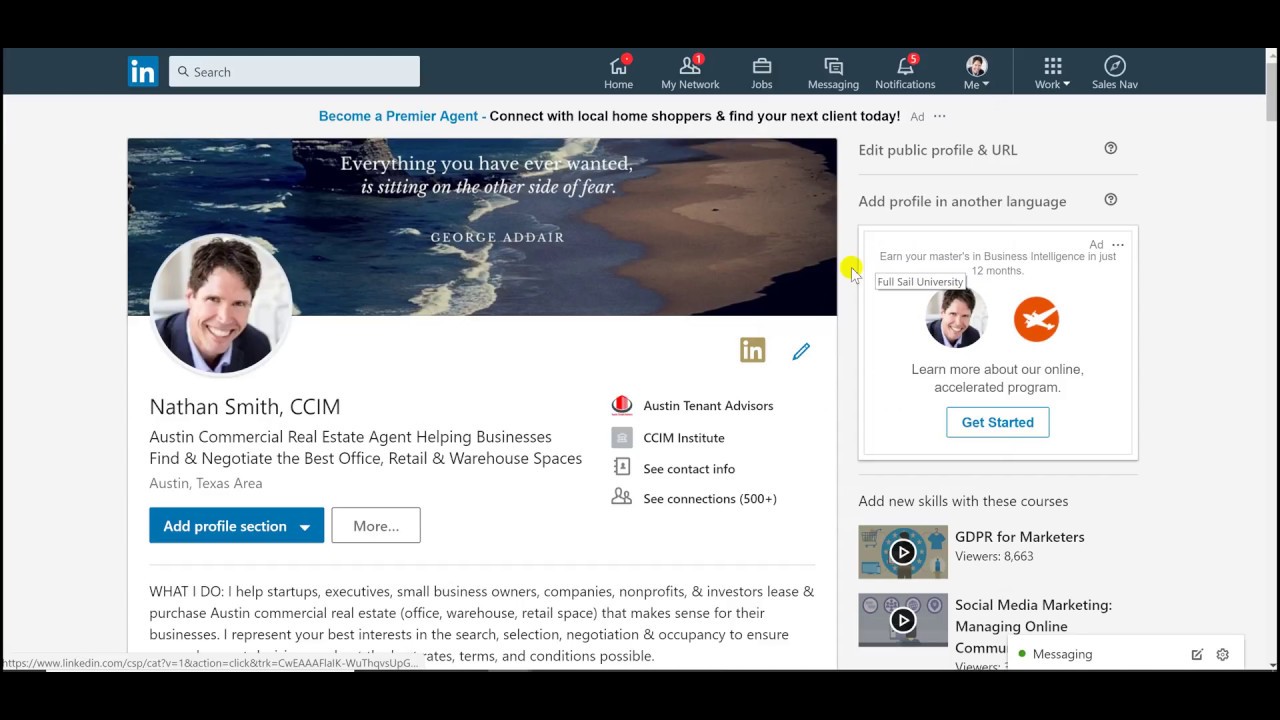

LinkedIn: Identify and interact with significant value people today and purchasers. Don’t forget to find key phrases like “investor”, “venture capital”, “angel”, “member of board”.

When making this listing try to be as comprehensive as you can, whilst not developing pointless function. Just leave it out.

Tip: Tend not to undervalue what you are able get by using your circle.

Now filtering system your listing

Now you have this massive report, you have to slim it because of all those traders along with the top chance of achievement.

To do this you can find about three vital requirements:

– Is the buyer serious about your organization?

– Can the buyer put money into your business?

– Is the best company considering the buyer?

Educate yourself on Part Six in our startup investors (check out the post right here) Funding Masterclass to get a step by step method and functional easy methods to determine these 3 crucial concerns.

3. How you can deliver a very good investment pitch?

When you have secured around the purchasers that you would want to invest in your new venture, it is actually the perfect time to persuade them.

All of it starts with creating the correct pitch.

To Some Extent Seven of the Masterclass “How to generate the right Pitch Deck” we explore at span ways to make the best pitch following a Airbnb illustration.

In conclusion, we would give the following tips.

A. Understand your audience

You happen to be talking with an exceptionally certain viewers and you will know its features:

– They may have short time for your personal pitch

– They are considering quite a few pitches each day

– They are trying to find possibilities by discovering signs of profitable firms (trader mindset)

To be effective, you should offer the hints in a very distinct and concise vogue.>

B. Understand the objective of the pitch

When designing your pitch, never lose appearance of just what you are aiming to do. You are hoping to tell a venture capitalist to buy your enterprise.

Buying startups is a very high-risk enterprise and a lot buyers are intensely reliant on a restricted degree of massive is the winner. A big get, that is what the opportunist is looking for. You have to present tips on how to be that up coming 10x expense.

The pitch deck is regarded as the most vital docs you can use to persuade purchasers, however it is also not the only report. Avoid as well as any potential detail and metric. It depends upon finding the purchasers thrilled and establishing yourself up for much more comprehensive discussion posts.

C. Key items to consist of

As a way to tell brokers, you should tell them of the adhering to essential products:

– Market program

– Chance to carryout

– Scalability

– Competitive edge

– Positive energy

Market chance

Any company’s upper reduce is its addressable sector. So as a way to influence a trader of the possibility of your company, you first need to tell them of the market for your merchandise.

A fantastic sector option is usually a blend of the following factors:

– A applicable dilemma that ought to be resolved

– Existing products/organizations that do not give you the correct option

– A the right time component that permits a fresh choice (legislation, purchaser behaviour, and many more.)

Ability to implement

Upon getting recognized that there is an appealing market place possibility, the problem occurs if you are the right crew for the task.

Investors are searhing for crews that are able to carry out.

Actually, lots of buyers would rather purchase an A crew executing a B merchandise than the opposite (trusting an A team to ultimately move on the right solution).

Scalability

In the event the market option is present, in addition, you will need for you to assist it.

The opportunity to help, attain and expand buyers within a scalable approach is vital.

Therefore your pitch must provide just as much evidence as you can that your business is scalable. Whether it is in your system or perhaps in your enterprise unit.

Competitive edge

Anything good current market carries a amount of rivals. For this reason shareholders are trying to find startups that may contend over time.

Highlight your unique cut-throat advantages whether it be a group effect, really hard-to-replicate engineering, or a chance to out-implement all the others.

Positive momentum

Finally, shareholders need to see the fact that market and shoppers agree with you. That the truth is, you are setting up a organization which can get.

Attempt to demonstrate your positive momentum by supplying onto your business strategy plan, expressing good innovations inside your product and of course shopper grip and development.

To discover how to have these guidelines and make your own personal ideal pitch deck, check out Part Seven of our Masterclass “How for making the best Pitch Deck”.

D. Nail your opportunist pitch

When pitching for an trader a very good pitch deck is important, but so is the way you give the pitch.

Folks are not really capable of supplying attention nor remembering.

Discover ways to use storytelling to get the investor’s interest making your pitch put to some extent Eight of our Masterclass “How to Nail Your Investor Pitch to get Funded? “.

4. What things to look for when negotiating with an buyer?

You might have pitched to buyers and a variety of them have an interest.

Now it really is a chance to start speaking about the word page, probably the most critical docs you may previously warning sign.

Just what is a time period page?

A term sheet is usually a no-binding published report that features the many important circumstances and terms and conditions of any offer. It summarizes the real key tips from the agreement arranged by each party ahead of executing the authorized arrangements and beginning eventually-taking in due diligence.

How come it extremely important?

This information can dictate the amount of you may like to see your start up develop, because it outlines the key terms of your cope with brokers.

As an business owner, you are looking to establish a online business, not negotiate an expression sheet.

But you also want to improve investment capital on the best situations attainable. You never would like to drop upside and management or take on improper disadvantage possibility.

The expression sheet is where to be sure this does not arise because it is all about splitting up this control, risk and upside somewhere between you and the traders.

Exceed dialogues and master all about the a variety of conditions and phrases, when it comes to a term page the devil is with the specifics.

To help make issues much worse, you will likely work out an expression sheet for the first time while the get together on the opposite side has accomplished 100s. So, you have to be geared up.

Start off by comprehending all the foundations in Part Nine of our Masterclass “The Ultimate Term Sheet Guide – all clauses and terminology explained”.

Tips and tricks

Term sheet discussions will likely be a difficult serious amounts of, with respect to the achievement of your organization, you could have pretty much make use of.

Know that the talks are a fun way to view how the VC really works,

Prior to make. In the event you really do not similar to the procedure, then you definitely should take this in thing to consider before doing permanent to this opportunist.

Try these tips when negotiating a term sheet:

Work with a very good lawyer: Raise enough income to pay for the legitimate costs and work with a solid strong with experience with any local VC ecosystem.

Know what to address on: After years of discussing commitments somewhere between VCs and firms numerous conditions have grown to be common process. An excellent lawyer will redirect your target to your clauses that are worthy of struggling more than.

Keep it uncomplicated: A great commitment is actually a contract for which either side understand fully the affect all the time. Push back again on conditions or on the option that is definitely hopelessly elaborate.

Clauses that are really worth battling more than are the adhering to:

Investment size: On the list of important people of the cope as well as your upcoming expansion opportunities would be the expense measurement.

Valuation: The valuation provides a immediate influence over your potential upside. Don’t go over the top on dealing valuation to get a complex deal system. You have to be sure that you simply plus the individual keep absolutely aligned down the road.

Liquidation inclination: In the low-seed bargain, a liquidation liking of 1x no-partaking should really be feasible. This clause possesses a large impact on your plus your employees’ upside.

Founder vesting: You will find a number of ways for VCs to safeguard themselves from your founder abandoning. One of these is a buyback, and that is certainly more appealing for yourself than turn back vesting.

Anti-dilution: We have a positive change amongst whole-ratchet or weighted-common, even if a type of zero-dilution will surely be integrated. Push back again on full-ratchet or limitation the volume of a purchase that may be secured. Anti-dilution is instantly linked with valuation. The more difficult you press on valuation, the harder the buyer will propel on contra –dilution.

Redemption rights: Fight rear tough, as they can be a ticking time bomb for your small business. Should you need to let them in, be sure that the disorders present you with plenty of time so you can reduce the total amount.

The clauses which are likely non-flexible are definitely the following:

Right-of-very first-refusal & Co-transaction Rights: Make certain that the privileges are drafted in a shape that is in-line while using conventional techniques.

Pre-emptive liberties And guru-rata liberties: These liberties may restriction your skill to usher in other shareholders down the road.

Board governance: A fantastic table is over a beat for regulate between you and the trader. Structure your board nicely, get quality practical experience aboard, plus your board could possibly developed into a precious cause of advice.

Voting protection under the law: Know the actual impact of voting liberties and why the individual really wants to incorporate them. Consult other investment portfolio providers to see what exactly is involved as well as how they are utilized. Here, a seasoned attorney can actually increase value.

BOOM! 💥 You’re prepared to improve funding just like a expert.

To go into far more details on one of the subjects, look into the related topic below:

The Length Of Time When Your Startup Runway Be?

9 Startup Funding Sources: Where and how for getting Funding for Your Startup?

When you Raise VC Money (then when to not)

The way to Split Startup Equity properly

Startup Funding Rounds: The Final Guide from Pre-Seed to IPO

How you can find the correct Investors

Steps to make the ideal Pitch Deck

How you can Nail Your Investor Pitch and obtain Funded?

The Best Term Sheet Guide – all clauses and startup investors terms and conditions described

All the best! 👊

If you require a fantastic CRM to set up your entrepreneur pipeline or even your revenue pipeline, we’ve have you coated there also 👇And>

A year ago was by far the most successful twelve months of fundraiser by African technician startups>

A year ago was by far the most successful twelve months of fundraiser by African technician startups> Greycroft Partners is really a US-dependent endeavor money company which generally invests in online press and technician startups. As outlined by Lot of money, they targeted early-stage businesses with small founders, usually in “seed” or “Series A” rounds. In line with the exact review, they have a keen involvement in startups that will be headed by lady creators and marketers. They just lately bought a Kenyan bitcoin settlement solution, BitPesa and Nigerian repayment choice, Flutterwave. They have two finances readily available: Greycroft IV, a $204 million enterprise account and Greycroft Growth II, a $365 million expansion-step account. Greycroft Growth II starts off at $10 million and often will shell out around $35 mil within a firm.

Greycroft Partners is really a US-dependent endeavor money company which generally invests in online press and technician startups. As outlined by Lot of money, they targeted early-stage businesses with small founders, usually in “seed” or “Series A” rounds. In line with the exact review, they have a keen involvement in startups that will be headed by lady creators and marketers. They just lately bought a Kenyan bitcoin settlement solution, BitPesa and Nigerian repayment choice, Flutterwave. They have two finances readily available: Greycroft IV, a $204 million enterprise account and Greycroft Growth II, a $365 million expansion-step account. Greycroft Growth II starts off at $10 million and often will shell out around $35 mil within a firm. One interesting legal job is that of a trial consultant. This is a professional whose job it is to advise a lawyer which potential jurors to try to get on the jury for a particular case. This might sound like an inexact judgment to make, but trial consultants use all sorts of sociological, psychological and technological tools in analyzing the background of a particular juror and deciding whether or not he or she is likely to decide in a lawyer’s favor given the facts of a particular case. (There was even a John Grisham novel that revolved around this particular occupation.)

One interesting legal job is that of a trial consultant. This is a professional whose job it is to advise a lawyer which potential jurors to try to get on the jury for a particular case. This might sound like an inexact judgment to make, but trial consultants use all sorts of sociological, psychological and technological tools in analyzing the background of a particular juror and deciding whether or not he or she is likely to decide in a lawyer’s favor given the facts of a particular case. (There was even a John Grisham novel that revolved around this particular occupation.) Investment associates at VC firms, their selves a tiny and unique coterie, tend to phone an likewise small-knit collection of academic institutions their alma mater. Inside of a finding that will distress nearly no one, Ivy League and Ivy-Plus institutions are heavily favored inside the top search rankings.

Investment associates at VC firms, their selves a tiny and unique coterie, tend to phone an likewise small-knit collection of academic institutions their alma mater. Inside of a finding that will distress nearly no one, Ivy League and Ivy-Plus institutions are heavily favored inside the top search rankings. For the best up-to-date details and news in regards to the coronavirus pandemic, go to the WHO internet site.

For the best up-to-date details and news in regards to the coronavirus pandemic, go to the WHO internet site.

Last year was essentially the most successful year or so of fundraising by African technological startups>

Last year was essentially the most successful year or so of fundraising by African technological startups>