You’d be standing on a gold mine should you have had invested just $1,000 in businesses like Amazon, Microsoft, Apple or Dell every time they experienced their first consumer offering (IPO). Naturally, the stocks of the organizations have multiplied oftentimes through since then. Prior to the IPO, picture if you had sunk prolonged! What could your investment decision be like now?

Each flourishing start up set about to be a homegrown concept. Testimonials like Sequoia Capital’s 12,000Percent go back from committing to WhatsApp could make you consider investment in the surface level of our next massive factor. Remember, altering startups towards a results tale involves work, threat and startup investment money.

Read Benzinga’s information. We description the hazards and advantageshazards and promote our very best practices so you can discover expense options with the soil levels.

Interactive Brokers – Lowest Cost And Best Execution

Margin rates only 2.43% $2.25 average equity profit $.70 ordinary choices payment for every commitment, no structure cost you Futures as low as $.32 for every arrangement all-in.

Table of materials [Hide]

– Start-Up Investment Platforms

– 1. AngelList

– 2. Gust

– 3. Wefunder

– Pros of Startup Investments

– Cons of Startup Investments

– Best Practices for Committing to Startups

– Industry Choice

– Research

– Diversification

– Post-Investment Involvement

– Join the Startup Investment Community

Start-Up Investment Platforms

Online financial investment systems allow for buyers like you -who will be appropriately named angels – to easily include this tool school to your purchase collection. Here are the best programs for startup Investment startups to raise capital from enterprise capitalists, angel traders and crowdfunding from the community.

1. AngelList

AngelList is one of the hottest start up trading tools available. The base features startups, from seed to publish-IPO, to safe money and angel shareholders. You’ll have first-fingers experience of the start-up ecosystem by way of a platform that permits you to investigate the fastest-growing businesses.

VC 101: The Angel Investor’s Guide to Startup Investing …

fundersclub.com › guides › the-risks-and-rewards-of-startup-investing

Startup investors are essentially buying a piece of the company with their investment. They are putting down capital, in exchange for startup investment equity: a portion of ownership in the startup and rights to its potential future profits.

The software comes with a position table, AngelList Talent, where you could implement secretly to over 130,000 technician and startup tasks which has a individual software. There’s one more Product Hunt section that enable you to be a part of thousands of very early producers and adopters in ready for the next big release.

AngelList means that you can make a circle by way of e mail encourage or relating social bookmarking profiles to raise your odds of obtaining funds. You may also use its research device to identify traders who are an excellent go with for your own start-up.

2. Gust

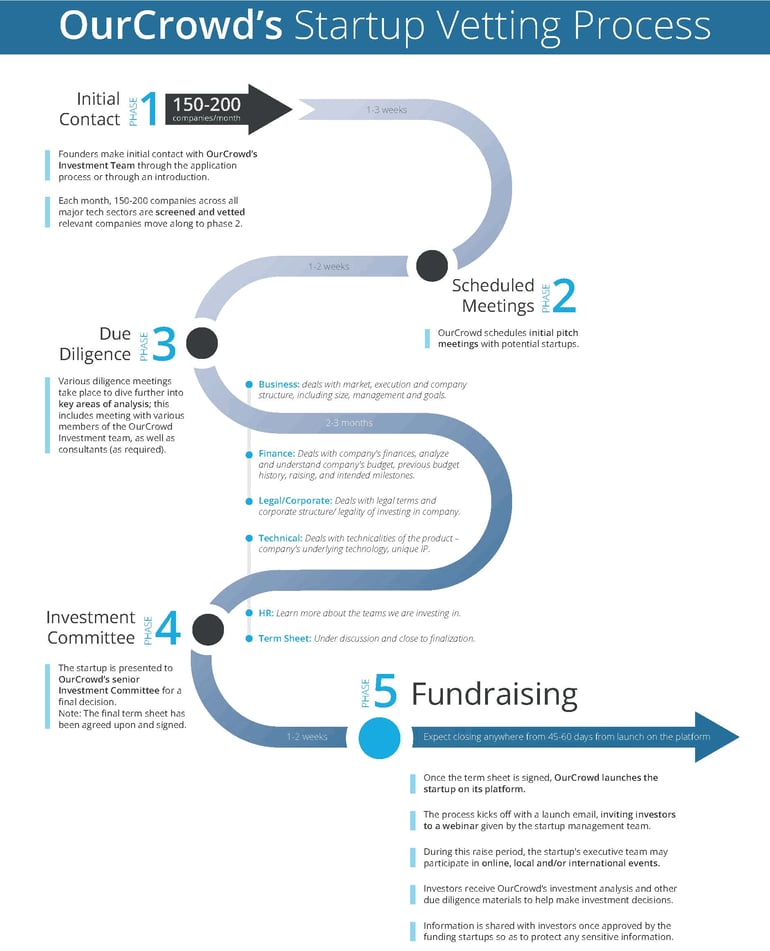

Gust is fairly different from other start up expense programs. As an alternative to behaving being an investing network system, Gust provides a SaaS platform by 80+ angel communities like OurCrowd, SeedInvest yet others. The platform has the resources licensed angel brokers, start-up plans and enterprise funds need to have.

Whether you are a venture capitalist syndicating a deal or even a startup software looking to link up traders with high quality start up expertise, Gust helps you investigate person choices, go over offers, keep track of and overview discuss and investments your probable investments with others.

The base offers a massive training video and proprietary details selection to help you stay abreast of the modern tendencies and also estimate potential future performance.

3. Wefunder

Wefunder has been in the crowdfunding sport for very long sufficient to realize how to get final results. You could spend as small as $100 within the startups you adore. The foundation helps account $55+ mil in startups like amusement, neighborhood, biotechnology and computer software companies.

Wefunder is strongly regulated by the SEC and FINRA. Whenever you make investments, your hard earned money is moved to an escrow profile. The funds are unveiled into the start up if the fundraiser is successful, or else, you will obtain a repayment. Generate a profile by means of some elementary data and start working on browse the available expenditure opportunities.

Pros of Startup Investments

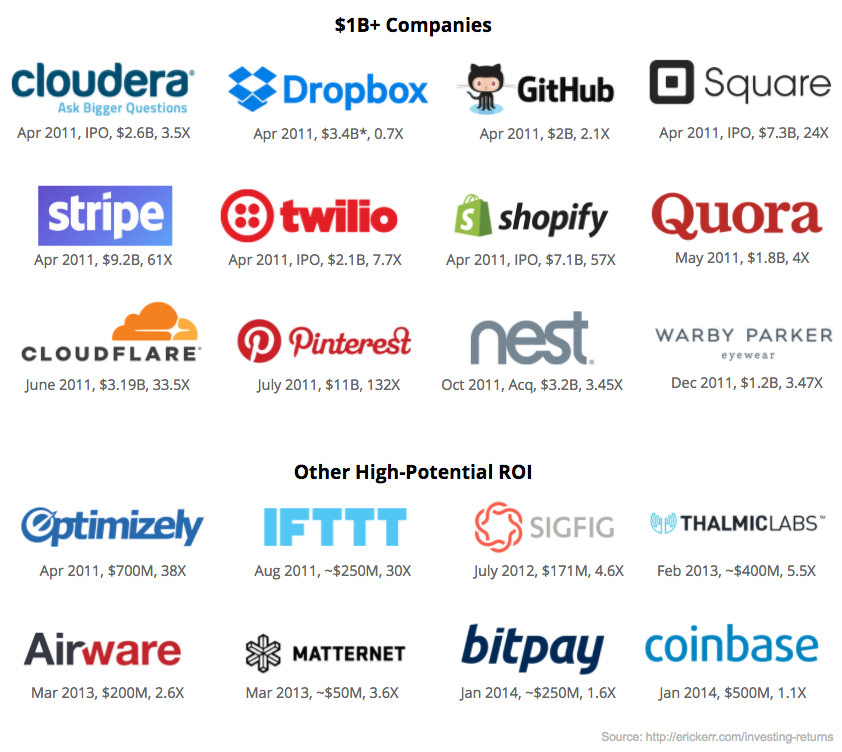

Several great-account business successes have established that applying dollars right into a start up is just about the handful of best ways to obtain and commit great earnings. Here’s what inspires shareholders to position their cash into startups:

Potential gains: With good arranging, new venture ventures are often very profitable. Pay attention to companies that deliver remedies, deliver benefit and create new movements within the previously-developing understanding-established economy.

Portfolio diversity: Startups are an advantage category that permits you to investigate a different expense station. Investments are high-risk, and a various collection suggests it is possible to limit the number of choices of getting a big hit during the downturn.

Job production: You’re improving the financial state transfer the proper route by being able to help an organization get on its ft, by placing hard earned cash to a new venture. If this is successful, you will have led to the development of work for no-shareholders.

An array of options: There are actually startups in virtually every market and current market. This way, it is possible to broaden your investment strategies all over sells and cover capacities, for example the rising market segments.

Buy-out prospective: Many startups are obtained by substantial organizations that obtain them like a possibilities opponent or would like to take advantage of the engineering produced by the start up. You’ll enjoy great profits with your investment.

Cons of Startup Investments

Despite their growth potential, startups are thought significant-potential risk ventures due to the fact just a smaller proportion is successful. Consider these drawbacks right before placing your hard earned dollars right into a startup.

Tremendous possibility: As worthwhile as it might be, you can invest in a corporation that do not ever is successful. Startup ventures are high-potential risk plus your roi is dependent upon the newest business becoming a results.

Wrong valuations: Most startups frequently give valuations more in-line with Silicon Valley, even though the business has not obtained traction. This produces a more complicated obstacle so that you can buy your new venture associated with preference.

Lack liquidity: Startup ventures cannot be dealt like openly dealt shares. Which means you can struggle to promote your risk before the clients are procured or moves consumer.

Best Practices for Paying for Startups

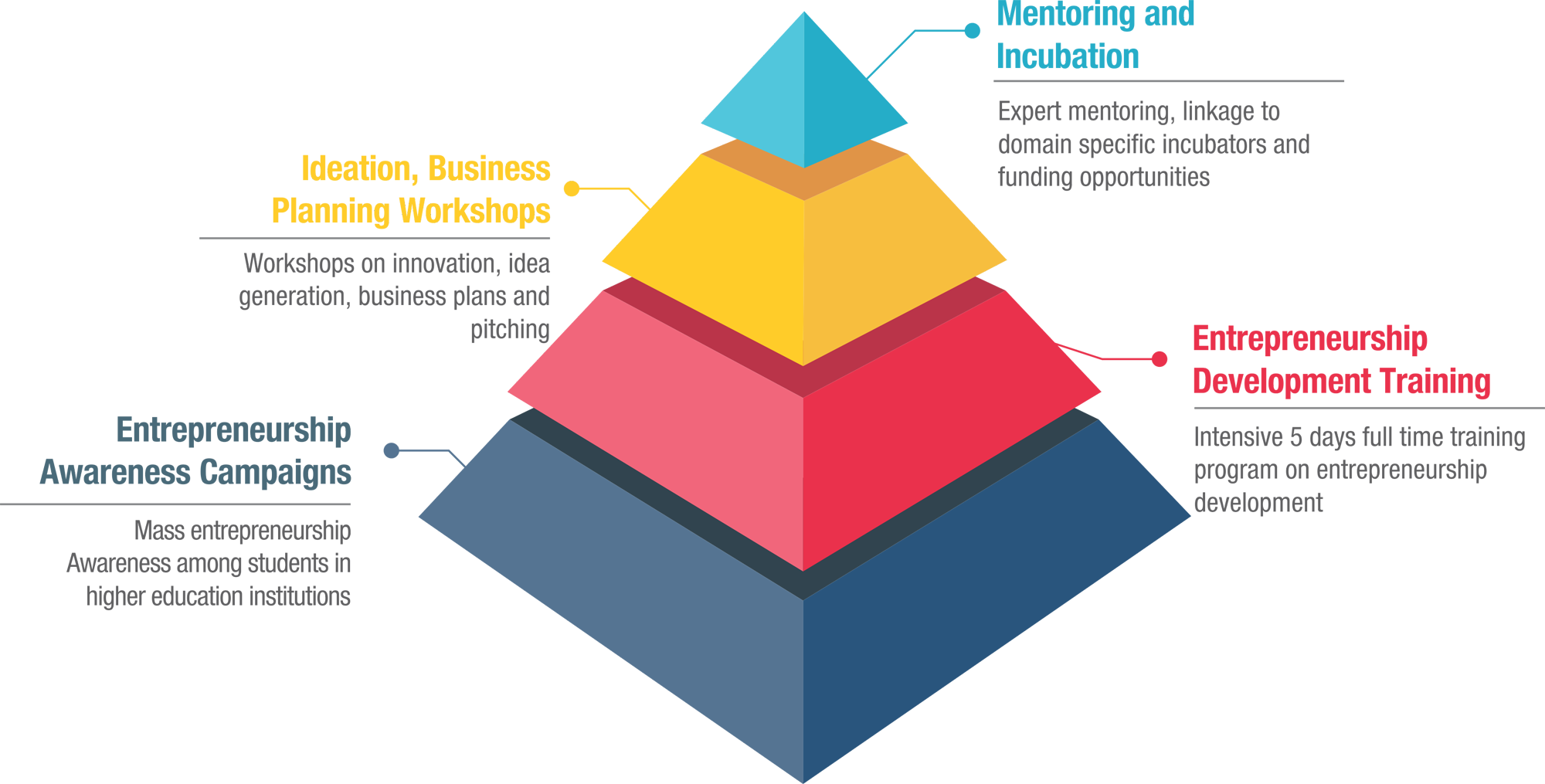

There are lots of options and strategies for making an investment in startups to optimize potential earnings and hedge some of the challenges. Here are some best strategies we advise.

Industry Choice

First of all, pick the start-up carefully, which includes its target and market market. Some market sectors will not make sound assets at specific times, considering the existing current market disorders. Some markets are hotter than the others. Consider your view of society’s requirements and path just before deciding on an investment.

Factors such as the investor’s experience in the industry also come into participate in when deciding on an investment inside a certain sector. As an example, maybe you have some information regarding the health care world that may be valuable when investing in a healthcare modern technology startup, if you’re a physician. Higher investment decision comes back will often be associated with an investor’s industry know-how.

Due Diligence

It is best to know very well what you set your hard earned cash into, so conduct research. Before signing an investment contract to definitely have an impact on your purchase outcomes, invest some time investigating a firm. Dig much deeper to the company’s economical files, find out about the founders and recognize just what the start-up promises to get rid of. The more information and facts you will have regarding a business, the higher quality poised you may be to make a smart purchase final decision.

Diversification

Whatever your skills is, it is recommended to branch out with your purchase group. You really should broaden further than 1 or 2 startups. Purchase a lot more start up firms to better your chances of landing a winner.

Diversification also may include preserving a collection of startups in varied industries with assorted enterprise tactics. You may also branch out according to the era of your startups – explore ahead of time-point, mid-period and overdue-point ventures. Multiple start-up companies give you a sugary location for developing a diverse profile.

You can also read more about purchase firms that offer you qualified prosperity operations.

Post-Investment Involvement

After creating your expenditure, one can find additional efforts you may make to raise the probability of a greater go back. This tends to consist of on a financial basis checking the business, mentoring the startup and aiding establish business associations on its behalf. You can even consider to have a board seating to keep up your higher level of post-expenditure effort.

Join the Startup Investment Community

The start up purchase landscaping is undergoing a renaissance. Individual shareholders now offer unparalleled use of financial investment possibilities which are one time only accessible to approved purchasers. There are various programs, styles and techniques of returns to check out and comprehend prior to your financial investment determination.

Be sure to branch out, sketch on earlier working experience and perform the legwork – consumer research and research. The benefits is often worthwhile.

Benzinga’s #1 Breakout Stock Each And Every Month

Looking for shares that are intending to breakout for increases of 10%, 15Per cent, even 20% most likely or higher? A small problem is choosing these shares usually takes a long time daily. Fortunately, Benzinga’s Breakout Opportunity Newsletter which could possibly bust out every thirty days. You may currently using this type of specific offer you:

Click the link for getting our Top breakout carry monthly.

Hire a Pro: Compare Financial Advisors In Your Neighborhood

Choosing the best economical expert that fits your needs doesn’t really need to be really hard. SmartAsset’s no cost tool games you with fiduciary financial advisors close to you in five a matter of minutes. Each specialist has long been vetted by SmartAsset as well as being within the law certain to work in the best interests. Get rolling now.

Investors can be called when during just about any step on the lifetime of a start-up. The following are several of the extremely frequent sorts of investors, and recommendations for when they will be regarded.

Investors can be called when during just about any step on the lifetime of a start-up. The following are several of the extremely frequent sorts of investors, and recommendations for when they will be regarded. Personal cost savings normally are available in two kinds: income and income-equivalent savings, and retirement bank account. Utilizing your particular savings may be practical. The required money is already available, and there is not any need to go into credit debt to generate it. The individual cost savings method can also be a tricky path to practice, having said that. In many cases, enterprisers search for brokers to begin with as their individual financial savings simply are not significant enough for demands. Additionally, it is individually tricky for many to gamble with money they will often in the future requirement for other uses, including pension, college capital because of their youngsters or individual obligations.

Personal cost savings normally are available in two kinds: income and income-equivalent savings, and retirement bank account. Utilizing your particular savings may be practical. The required money is already available, and there is not any need to go into credit debt to generate it. The individual cost savings method can also be a tricky path to practice, having said that. In many cases, enterprisers search for brokers to begin with as their individual financial savings simply are not significant enough for demands. Additionally, it is individually tricky for many to gamble with money they will often in the future requirement for other uses, including pension, college capital because of their youngsters or individual obligations. SoftBank’s Vision Fund would be the initial – and very last – $100 billion dollars financial investment auto.

SoftBank’s Vision Fund would be the initial – and very last – $100 billion dollars financial investment auto.

Venture investment capital (often known as private value) would be the answer should you require further financing however they are not capable or reluctant to increase your borrowings.

Venture investment capital (often known as private value) would be the answer should you require further financing however they are not capable or reluctant to increase your borrowings.

Headhunters are now using LinkedIn as one of their primary tools to source new talent for Employers. Business Owners and Employers have also become aware of just how useful LinkedIn is to search for talented professionals to fill positions – cutting out the middle man and major advertising costs. Over 130,000 recruitment agents including representatives from all of the Fortune 500 Companies are using LinkedIn to source their future employees and contractors.

Headhunters are now using LinkedIn as one of their primary tools to source new talent for Employers. Business Owners and Employers have also become aware of just how useful LinkedIn is to search for talented professionals to fill positions – cutting out the middle man and major advertising costs. Over 130,000 recruitment agents including representatives from all of the Fortune 500 Companies are using LinkedIn to source their future employees and contractors.