Investors are exceptional athletes in the growth strategy of an enterprise. The levels and level of quality of these engagement can in the end guide establish a company’s being successful or breakdown. It is critical for newbie business people to make time to read about the types of brokers readily available and the ways to use best procedures when coming them for funds.

5 sorts of shareholders

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed.

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed.

Banks

Banks are really a traditional provider for startup investment organization financial loans, Inc. clarifies. Loan-seekers in most cases be required to generate proof of equity or possibly a profits steady stream before their application for the loan is authorized. Finance institutions are frequently a far better choice for more recognized corporations.

Angel brokers

Angel investors are people with an received earnings that exceeds $200,000 or with a value of over $1 zillion. They may be uncovered around all market sectors and are generally good for business owners who happen to be beyond the seed periods of finance but you are not yet willing to search for business money.

Peer-to-peer loan merchants

Peer-to-peer loan companies are persons or groups offering money to small businesses, Time reports. To cooperate with these investors, entrepreneurs should implement with organizations specializing in peer-to-peer loaning, for example Prosper or Lending Club. Once their application form is accepted, lenders could then establish the businesses they wish to assistance.

Venture capitalists

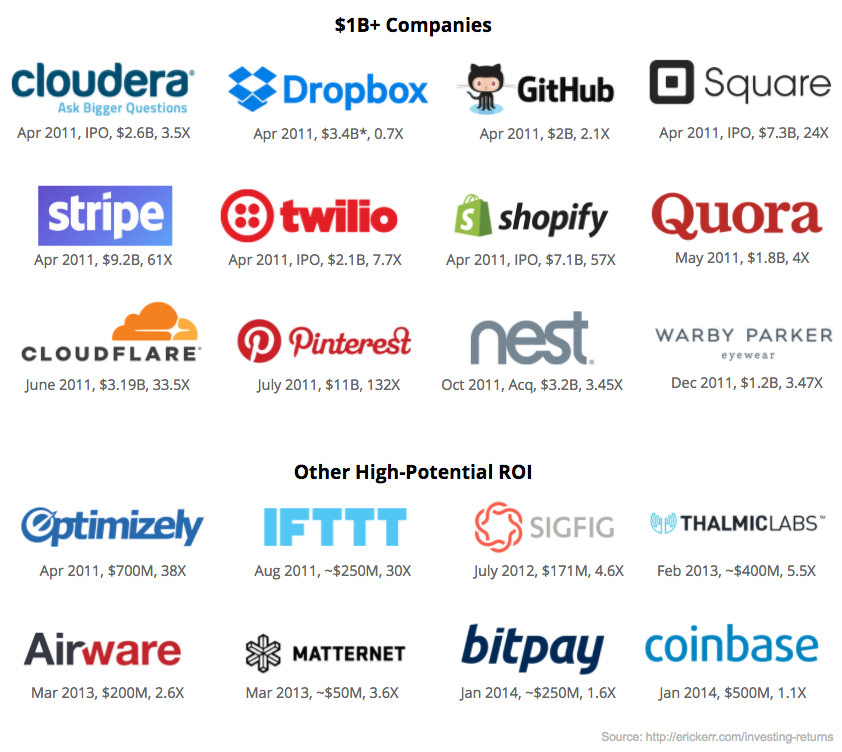

Venture capitalists are being used only from a organization actually starts to reveal a lot of cash flow. These shareholders are well known, since they normally invest a large amount of dollars (usually about $10 million). They get the vast majority of their comes back via “carried attention,” or maybe a portion acquired as salary out of the earnings of the hedge account or personal collateral.

Personal traders

Business people usually depend on family members, close friends or near associates to buy their corporations, particularly in the beginning. However, you will discover a limit to how many of these folks can invest in startups on account of legitimate disadvantages, Legal Zoom clarifies. While it may be effortless to influence loved ones to aid, detailed paperwork is quite advisable.

Related: Why Venture Angel and Capitalists Investors Look at Teams, Not Ideas

How you can find the appropriate opportunist for the start-up

Know the unique expense possibilities one has

When attemping to start a corporation, business people can receive capital by means of means except for investors, Forbes talks about. Personal financial savings and private borrowing are two frequent strategies to do so.

Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts.

Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts.

Personal borrowing is wonderful for startup Investment internet marketers with notably sturdy credit scores (700 or higher) plus a large personal value. To receive money for their new clients, these people might take out a personal loan or make application for startup investment a new visa or mastercard. The risk (much like borrowing for any kind) is the chance of going down at the rear of on payments, bringing down your credit rating and sinking even more into credit card debt.

Decide what you desire from the investors

How Can Average People Invest in Startups? – The Balance

www.thebalance.com › Investing › Investing for Beginners

Fortunately, startup investment investing by average investors became easier in 2012 with the passage of the Jumpstart Our Business Startups Act (JOBS), which relaxed …

Choosing an investor is all about greater than simply attempting to receive resources. This also suggests a particular degree of motivation. As outlined by Business owner, make sure you acquire supply of your experience you require and the objectives you may have before selecting to tactic a specific entrepreneur. In terms of prospective traders, you must think of their latest transactions, the help they might provide, the anticipations they have got for company management and just how required they want to have corporation business.

Know where you should search

Although discovering brokers might appear intimidating, it only needs researching in the right place. You can actually take full advantage of buyer directories including AngelList, Angel Capital Association or Angels Den to get going. Self-marketing and advertising will also help. Writing blog participating, marketing and blog posts in group enterprise pursuits could lead to traders going after marketers preferably.

Create a trader shortlist

To enhance your odds of achieving resources, it is best to narrow down your set of possibilities shareholders only to individuals that seem appropriate. Criteria to do this report can be items such as investor’s earlier partnerships, good reputation or any mutual associations. Their list ought to include close to 30 to 50 titles, which you can put into a spreadsheet with many other suitable info for straightforward research.

Review your sites

Investors have the desire to reduce chance, this means they are more inclined to have attraction when they know you or when you have been strongly suggested. Examine your qualified systems to hair comb for prospective connectors with the purchasers involved and carefully look at the proper individual to help with making introductions.

Perfect your pitch

Once you have an investor’s attention, a sales hype is the best possiblity to clinch the offer. It (essentially) compensates to put together. Think about the promoting issues that communicate far better to the special target audience you’re coming. Build a “hook” at the outset of your pitch make certain it leads to a conversation of how your products or services will get rid of a problem. It’s important too to possess a very clear business strategy and explore what sort of entrepreneur will earnings.

Ultimately, marketers who take your time to find investors customized to the distinct economical and operating requirements will create the basis needed for a productive and longer partnership.

Sign-up: Obtain the StartupNation e-newsletter!

Understanding trading

Individuals desperate to see the difficulties of modern corporation finance can earn an online business amount from Point Park University. The web Bachelor of Science in operation Management attributes an entrepreneurship focus, even though the online MBA permits individuals to be specialists available subject. Both courses are designed for maximum convenience, enabling university students to produce true-society techniques on the timetable that best fits their requirements.