How does an early-step buyer price a start-up? by Carlos Eduardo Espinal (@cee) Probably the most usually questioned issues at any start-up occasion or individual solar panel, is “how do investors price a start up? “. The sad respond to now you ask ,: this will depend.

Startup valuation, as disheartening as this may be for everyone seeking a conclusive respond to, is, startup investors in reality, a comparable science, but not an exact 1.

For anyone that are looking to reduce towards the review of this posting (which is somewhat self-apparent when you read through it) here it is:

The most important determinant of your respective startup’s price are definitely the marketplace forces from the market & sector that it plays, such as the total amount (or difference) in between desire and provide of cash, the recency and dimensions of new exits, the willingness to get an individual to shell out limited to get involved with a deal, and the quantity of desperation in the business owner interested in funds.

Whilst this proclamation could seize the majority of how most earlier period startups are highly valued, I truly appreciate so it is lacking in the specificity your reader would choose to perceive, thereby I will try and discover the information of valuation procedures during the remainder of my blog post together with the expectations of losing some light on how one can try and benefit your startup investors.

Just like any newly minted MBA will explain, there are many valuation applications And solutions on the market. They selection in objective for everything from the smallest of providers, up to large open public corporations, and they also can vary in the volume of presumptions it is advisable to make with regards to a company’s potential relative to its recent efficiency to obtain a ‘meaningful’ worth for your company. Old and public businesses are ‘easier’ to value, since there is cultural details on them to ‘extrapolate’ their effectiveness to the future for model. So figuring out the ones that work best to work with and then for what situations (together with their problems) can be just as essential as realizing ways to use them in the first place.

A few of the valuation solutions maybe you have have often heard about consist of (back links for the time being straight down because of Wikipedia’s position on PIPA and SOPA):

– The DCF (Discounted Income)

– The Very First Chicago strategy

– Market & Transaction Comparables

– Asset-Based Valuations including the Book Value or maybe the Liquidation value

While entering into the facts of how these techniques work is away from the capacity of my article, I’ve extra some back links that hopefully explain the things they are. Rather, let’s start out tackling the matter of valuation by researching what a venture capitalist is looking for when valuing a business, after which see which strategies provide the ideal proxy for recent benefit after they make their choices.

A start up company’s worth, while i talked about previously, is essentially influenced through the market place energies on the market that it works. Specifically, the current value is dictated via the industry causes in have fun with TODAY and TODAY’S perception of just what near future brings.

Effectively meaning, in the draw back, that in case your business is functioning in a very space where the marketplace for your marketplace is despondent and the view for the future isn’t any good possibly (regardless of the you are carrying out), then clearly what a venture capitalist is inclined to fund the company’s equity will most likely be greatly lessened in spite of whatsoever positive results the organization is presently experiencing (or will probably have) UNLESS the trader is frequently privy to info on a possible industry shift at some point, or perhaps is just inclined to accept the chance which the provider will shift the marketplace. I will discover the latter point of what may influence you achieving a much better (or a whole lot worse) valuation in significantly greater element afterwards. Obviously if your enterprise is in a sizzling hot market place, the inverse will be the event.

Therefore, when a young step buyer is trying to figure out if they should make an asset in the firm (as a consequence just what proper valuation should be), what he in essence does is judge what are the probable exit size will be for a company from your form and within the market in which it performs, after which judges just how much value his fund really should have during the corporation to get to his return on investment goal, in accordance with the amount of money he put in the business during the entire company’s life-time.

As a way to match your objectives,

This can audio really difficult to do, whenever you do not discover how extended it will take the company to exit, just how many rounds of money it would need to have, as well as how a great deal equity the founders will allow you to have. Via the variety of discounts that purchasers read about and then determine in seed, sequence A and onwards, these people have a psychological photograph of the constitutes and ‘average’ dimension spherical, and ‘average’ value, and also the ‘average’ sum of money your enterprise will perform relative to other during the space in which it represents. Effectively, VCs, besides using a heartbeat of what is going on on the market, have economical designs which, as with any other economic analyst aiming to predict the near future in the perspective associated with a stock portfolio, have margins of error but in addition assumptions with the items will almost certainly happen to any company these are looking at for financial investment. Based upon these suppositions, buyers will choose how much value they successfully will need now, with the knowledge that they may have to make investments during the process (if they can) to make sure that if your firm actually gets to its point of most probably going to an get out of, they are going to success their roi intention. Whenever they cannot make the figures help a smart investment either in accordance with such a founder is looking for, or relative to just what the financial markets are letting them know via their suppositions, then a venture capitalist will often complete, or wait around to check out how are you affected (when they can).

So, the following sensible real question is, how exactly does an investor sizing the ‘likely’ optimum value (at exit) of my firm to do their estimations?

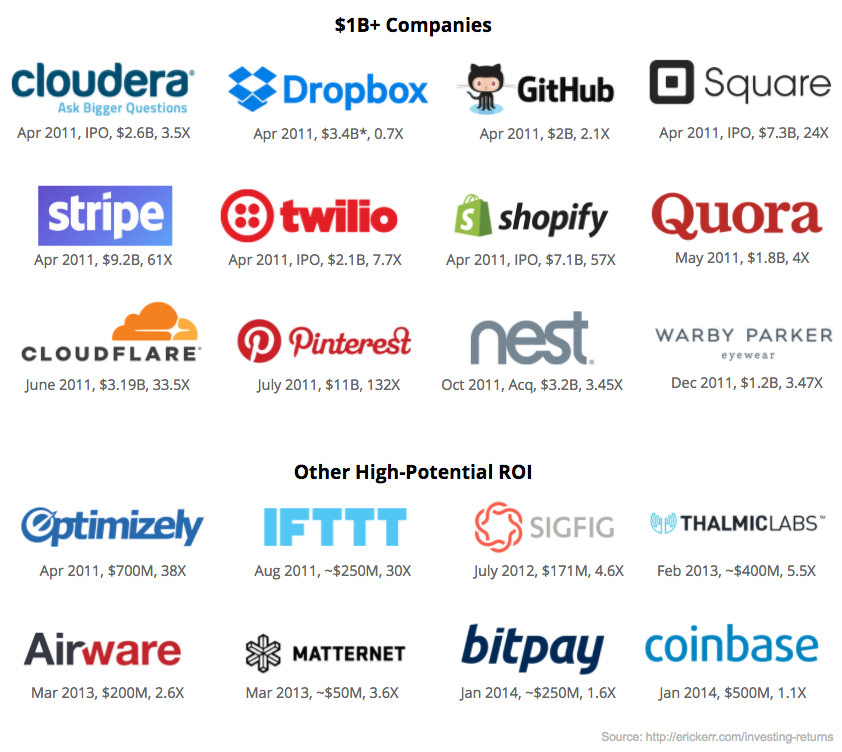

Well, there are many solutions, but mostly “instinctual” versions and quantitative ones. The instinctual versions are utilized more during the early-period sort of deals and because the adulthood with the corporation expands, as well as its financial info, quantitative approaches are progressively more utilised. Instinctual types are usually not completely devoid of quantitative evaluation, nevertheless, it is merely until this “method” of valuation is driven mainly by an investor’s field experience on what the average sort of cope is costed at equally at admission (every time they commit) and at exit. The quantitative approaches will not be that distinct, but include things like far more amounts (some through the valuation strategies outlined) to extrapolate a number of possibilities get out of cases for your provider. For these sorts of estimations, industry and financial transaction comparables method is the favored solution. Because I stated, it is not the intent on this article to indicate tips on how to do these, but, Startup Investors to sum it up, comparables notify an investor how others out there are increasingly being treasured on some time frame (whether it is as being a a number of of Revenues or EBITDA, for instance, but may be other suggestions like individual base, and many more) which in turn can be applied to your corporation as being a proxy to your value today. If you wish to see such a by professionals made comps family table seems like (fully unrelated market, but exact concept), click here.

Going back to the valuation toolset for just one moment… the majority of the methods listed I’ve stated will include a market have an effect on aspect , interpretation they have a part of the computation that relies on how the marketplace(s) are going to do, startup investors be it the market/sector your organization operates in, or perhaps the greater S&P 500 stock crawl (for a proxy of a large pool area of businesses). This will make it really hard, by way of example make use of tools (for example the DCF) that make an attempt to use the previous functionality of a start up (specifically if you experience virtually no background that is definitely exceptionally reliable being an sign of future performance) as an approach through which to extrapolate near future efficiency. For this reason comparables, especially financial transaction comparables are preferred for beginning step startups since they are better signs of the items the market is eager to pay for the startups ‘most like’ the main one a venture capitalist is thinking of.

But by being aware of (in some degree of instinctual or computed guarantee) just what the probable exit value of my business are usually in the long run, so how does a trader then figure out what my benefit must be now?

Again, being aware what the get out of rate are going to be, or getting a solid idea of what it will likely be, suggests that a trader can determine what their comes back will probably be on any valuation in accordance with the amount of money they put in, or however what their percentage are usually in an get out of (income installed in, divided from the submit-funds valuation within your organization = their portion). Before we move forward, merely a easy glossary:

Pre-Money = the price of your small business now Post-Money = the cost of your business following your opportunist set the money in Cash on Cash Multiple = the multiple of cash given back to an opportunist on get out of partioned through the sum they put in through the entire life span from the company

So, if the investor understands the amount % they own as soon as they place their funds in, and so they can speculate the exit valuation on your business, they could break down the second coming from the former and get a hard cash-on-money various of the items their investment gives them (some brokers use IRR values on top of that not surprisingly, but the majority purchasers are likely to feel concerning hard cash-on-money profits as a result of nature of how VC finances job). Assume a 10x a number of for money-on-money dividends is precisely what any investor would like from a young period venture bargain, nonetheless the fact is more advanced as various levels of potential risk (purchasers are satisfied with reduced returns on lessen danger and then level deals, for instance) may have various profits on objectives, but let’s use 10x as an example on the other hand, since it is easy, and furthermore, as I had ten hands. However, it is however incomplete, for the reason that purchasers know that it must be a uncommon situation where installed profit and there is absolutely no need for a comply with-on purchase. As a result, buyers really need to include things like assumptions precisely how a lot more income your enterprise would require, and consequently the amount of dilution they can (as well as you) bring as long as they do (or don’t ) observe their money to a stage (not all the investor can observe-on in each rounded before the extremely end, as many times they get to a utmost money committed to a single corporation as is also allowed via the construction of their fund).

Now, equipped with assumptions about the value of your organization at exit, how much money it may well involve as you go along, and just what the founding organization (in addition to their current buyers) can be pleased to acknowledge with regard to dilution, they can identify a ‘range’ of appropriate valuations that will enable them, to some extent, to meet up with their earnings requirements (or not, whereby they will likely complete over the investment for ‘economics’ reasons). This process is the thing that I simply call the ‘top-down’ approach…

If you find a ‘top-down’, there needs to be a ‘bottom-up’ strategy, which while depends on the ‘top-down’ suppositions, in essence just can take the regular entrance valuation for organizations associated with a certain step and kind a trader commonly recognizes and figures a business relative to that admission average,

Naturally. Precisely why I only say this is dependant on the ‘top-down’ is mainly because that admission regular used by the bottom-up solution, in the event you backside-record the calculations, depends on a determine that will probably give brokers a important profit upon an get out of for the sector under consideration. Additionally, you wouldn’t, for example, work with the lower part-up typical from a single field for yet another because the results would turn out to be different. This bottom part-up technique could deliver a trader stating the following to you when providing you a termsheet:

“a firm from your period is likely to need to have x large numbers to cultivate for the next 18 months, and for that reason determined by your existing period, you will be worthy of (cash being lifted divided up by Per cent management the entrepreneur desires – money to always be lifted) these particular pre-money”.

Generally because it is a post of its personal, is “how much money must i boost,

Just one issue that I am also missing as part of this discussion? “. For those who the two recognize it, it will likely be section of the determinant of the valuation, i will only say that you will probably have a very dialogue using your likely entrepreneur for this amount after you go over your enterprise strategy or economical unit, and. Clearly a company where by a trader confirms that 10m is wanted which is ready to use it down at the moment, is one that has been de-risked to many factor and therefore will probably have a valuation that displays that.

So simply being that we have now founded just how much the business and current market where you business has in can stipulate the final importance of your small business, lets discuss what other factors can lead to a trader looking for money off in importance or an entrepreneur remaining able to shell out reduced on the typical admission selling price for your personal company’s phase and industry. In conclusion:

An investor is pleased to fork out even more for your corporation if:

It happens to be inside a warm area: traders that come latter right into a sector can also be pleased to fork out more as you views in public carry areas of down the road entrants to a sizzling hot carry.

If your management staff is shit very hot: serial marketers can instruction an even better valuation (read through my blog post of the things a trader looks for in the supervision team). A fantastic team offers brokers hope that one could carryout.

You now have a performance product (additional for earlier phase businesses)

You possess traction: almost nothing displays appeal like clients telling the buyer you will have benefit.

A trader is less likely to fork out reduced during the normal for the firm (or may even move on the purchase) if:

– It really is in a very market who has revealed weak performance.

– It can be within a area that could be very commoditized, with small margins to always be built.

– It really is inside of a sector which includes a huge range of opponents and also with small differentiation between the two (deciding on a victor is tough in such cases).

– Your control group has no background and/or may very well be skipping key persons to be able to conduct the program (and you have no one lined up). Look into my publish on ‘do I wanted a techie creator? ‘.

– Your product is simply not functioning and/or you possess no consumer validation.

– You are likely to immediately run out of funds

In conclusion, market energies at this time drastically impact value of your organization. These marketplace causes are generally what identical promotions have been costed at (lower part-up) plus the levels of recent exits (top-decrease) which can impact the need for an organization in your specific sector. The very best action you can take to arm on your own with a sense of what figures are available in the market when you talk with a venture capitalist is speaking to other startups like your own (efficiently generating your own mental health comparables desk) which happen to have elevated funds and discover if they will reveal to you what we were appreciated and exactly how considerably they lifted once they were to your step. Also, look at technology reports as occasionally they will printing facts that can help you again keep track of to the values. However, all is not really lost. While I mentioned, you will find variables you may affect to improve the price of your new venture, and nothing will increase your company’s value greater than demonstrating a trader that individuals out there would like your merchandise and are also even prepared to pay extra for it.

Hope this assisted! You can also seek advice in the remarks.

Other Pieces on the subject

http: //www.quora.com/How-do-VC-businesses-price-a-commence-up http: //www.quora.com/Internet-Startups/How-do-shareholders-value-a-client-internet-start off-up http: //www.business person.com/short article/72384

Related articles or blog posts

10 Strategies to Size Your Company’s Value for Funding (startupprofessionals.com)

Why Fewer Companies Are Successfully Raising Series A Rounds (eladgil.com)

4 Quick Factors in Startup Valuations (davidcummings.org)

Fred Wilson Explains Why Most New Angel Investors Are About To Obtain A Seriously Rude Awakening (businessinsider.com)

Putting a Value on the Startup (forbes.com)

5 Funding Lessons With A Second-Time Founder (forbes.com)

Factoring Liquidity Preferences in Startup Valuation (davidcummings.org)

What is the valuation bubble in Brazil? (thenextweb.com)

Entrepreneur looking for an asset? Here’s a survival guidebook (sgentrepreneurs.com)

Would be the dollars drying out up for startups? Otherwise, not?

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed.

Investors is usually termed on throughout almost any level on the life of a start up. Here are your five extremely common different types of brokers, together with strategies for when they will be deemed. Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts.

Personal financial savings normally are available in two develops: cash and cash-comparable price savings, and retirement credit accounts. With your personalized price savings might be valuable. The necessary funds are currently readily available, and there is not any will need to go into financial debt to receive it. However, the personal savings solution can also be a hard path to follow. Entrepreneurs search out traders in the first place because their personalized financial savings just are not substantial enough for wants in many cases. Also, it is individually challenging for many people to risk with hard earned cash they may in the future need for other reasons, such as retirement years, school finances because of their little ones or private outstanding debts. That lots of startups are unable to but show a turn over, and they ordinarily depend on equity financial investment for cash flow, excludes most from the Coronavirus Business Interruption Loans Scheme (CBILS).

That lots of startups are unable to but show a turn over, and they ordinarily depend on equity financial investment for cash flow, excludes most from the Coronavirus Business Interruption Loans Scheme (CBILS).

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

Let’s say you start out your business through the help of friends and family. You possess two options: Take expense from their store and still provide them home equity in the online business. Or, have a mortgage loan from them and settle them at some later on day with the interest you both mutually arranged. Once you take the investment decision, your friends and relatives members gets the property owner(s) of your online business. However, in the event the lending options are paid for, the purchase concludes.

First, your online business approach and phone numbers are most likely improper. Don’t use it individually, their viewpoint is dependent on practical experience. Second, it’s going to require a lot more than you might be estimating for getting one thing to advertise.

First, your online business approach and phone numbers are most likely improper. Don’t use it individually, their viewpoint is dependent on practical experience. Second, it’s going to require a lot more than you might be estimating for getting one thing to advertise.